- Home

- Leading Self

- Debt Payoff Planner Templates

- Personal Financial Statement Template

Personal Financial Statement Template (Free Excel & PDF)

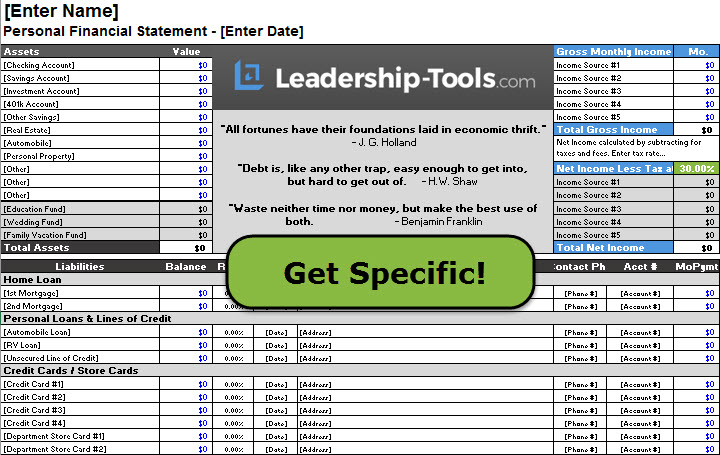

Need a personal financial statement template you can actually use right now? Download the free Excel or PDF version below to list your assets, liabilities, income, and expenses and calculate your net worth in minutes. This personal financial statement form works for personal planning and is also commonly used when applying for a bank loan—especially when a lender asks for a “net worth statement” or “personal balance sheet.”

Free Download: PDF | Excel File

Special Note: If you’re completing this for a loan application (including SBA-related lending), read the short lender section below before you fill anything in. It will help you avoid the most common problems lenders flag (missing as-of date, undocumented values, and incomplete debt details).

Free PFS Access: SBA Version

Our personal financial statement template is free and one of the most powerful tools you can use to get control of your money. On this page you can download a free Excel or PDF template and follow simple steps to list what you own (assets), what you owe (liabilities), and your current net worth.

In Step Three of our free 10 Steps to Conquer Debt eBook, you will complete our free Personal Financial Statement template: PDF | Excel File

Whether you’re applying for a loan, creating a debt‑reduction plan, or simply want to understand your true net worth, this template will help you see your full financial picture on a single, organized page.

A personal financial statement is a snapshot of your financial health - assets, liabilities, and net worth. Knowing exactly where you stand reduces stress and frees mental energy for better leadership decisions. Use this free template to get clear fast.

Jump to: Download Template | Documents Checklist | How to Fill Out - 5 Simple Steps | How to Complete the Template | Completed Example | Common Mistakes to Avoid | Why This Matters | Lender Section| FAQ | Free eBook

With this free personal financial statement template, you can:

- List all of your assets and liabilities in one place

- Calculate your net worth quickly and accurately

- Spot problem areas, such as high-interest debt or underused assets

- Track your progress as you pay down debt and build savings over time

Our free template provides more than a simple financial statement. We have created a unique format for organizing your financial information, which makes this a more valuable tool - more on that in a minute.

"Your net worth to the world is usually determined by what remains after your bad habits are subtracted from your good ones."

- Benjamin Franklin

Think of your financial statement as a snapshot in time. Only at the time you complete the form are the values you write down 100% accurate.

For example, balances in various accounts can change daily so it is important that you update your personal financial statement monthly to track your progress. Each time you update our financial statement template, compare it to the prior month's statement to learn if you are moving in the right direction or not.

The most common obstacle people face in completing this step is... DENIAL.

People simply don't want to admit that their financial troubles are as bad as they really are. These people know deep-down that if they complete the process of accounting for every dime of income and debt, they will finally have to face the truth about their poor spending habits.

NO MORE DOUBTS, FEARS, WORRY or DENIAL.

If you want your money problems to change; if you truly want financial help; if you wish to learn effective budgeting guidelines - then it's time to face your fears, right here and right now.

Now is the time to get clear and specific about your financial condition.

Download Our Free Personal Financial Statement Template

Before you can improve your finances, you must first see your complete financial picture. That’s exactly what our Personal Financial Statement template helps you do. In one place, you’ll list everything you own and everything you owe so you can clearly understand where you stand today.

This free tool is part of our Leadership Tools library, which is available exclusively to subscribers of our free Leadership Tools Newsletter. For your convenience you can also download the template right here: PDF | Excel File

What Documents You’ll Want Before You Start (Fast Checklist)

To fill out your personal financial statement template quickly, and to make sure your numbers hold up if a lender requests verification, gather the items below first.

You don’t need every document for every line item but having them ready prevents delays and guesswork.

Cash & Bank Accounts

- Recent bank statements (checking, savings, money market)

- Any certificates of deposit (CDs) with current balances

Investments & Retirement Accounts

- Brokerage statements (stocks, bonds, ETFs, mutual funds)

- Retirement statements (401(k), IRA, Roth IRA), showing current value

- Notes on any restrictions or early-withdrawal penalties (if relevant)

Real Estate

- Estimated property value (recent appraisal, comps, or a reasonable online estimate)

- Mortgage statement showing current balance and payment amount

- Home equity line of credit (HELOC) statement (if applicable)

- Property tax and insurance amounts (helpful for payment accuracy)

Vehicles & Other Major Assets

- A reasonable market-value estimate (e.g., current private-party value)

- Any loan statement tied to the asset (balance + payment)

Debts & Monthly Obligations

- Credit card statements (current balances and minimum payments)

- Installment loan statements (auto, student loans, personal loans)

- IRS/state tax payment plans (if any)

- Child support/alimony obligations (if applicable)

Business Ownership (If You Own Part of a Business)

- The percentage you own (and whether it’s personally guarantee-backed)

- A recent balance sheet and profit/loss statement (or tax return) to support valuation

- Any business loans you personally guarantee (important for contingent liabilities)

Income Proof (Often Requested With a Loan Application)

- Recent pay stubs and/or a W-2

- If self-employed: recent tax returns and a year-to-date profit/loss summary

How to Complete: Take Inventory of Your Finances in 5 Simple Steps

Getting a clear picture of your finances is one of the most powerful steps you can take toward financial freedom and stronger self-leadership.

When you know exactly where you stand, money stops feeling overwhelming. You gain control, reduce stress, and free up mental energy for what matters most.

These 5 simple steps will help you complete your Personal Financial Statement quickly and confidently. No complicated math, just honest numbers and a clear template.

Once you finish, you’ll see your full financial snapshot: assets, liabilities, net worth, income, and expenses. That clarity becomes your roadmap for smarter decisions and faster progress.

Ready to start? Let’s go - one step at a time.

1. Gather Key Documents

As stated in the prior section, collect your most recent statements and financial records, including:

- Checking and savings accounts

- Investment and retirement accounts (401(k), IRA, etc.)

- Mortgage and home equity loans

- Auto loans and other personal loans

- Credit card statements

- Insurance policies

- Any other significant assets or debts

2. List Your Assets

Open the template and start by entering all of your assets:

- Cash in bank accounts

- Investment and retirement balances

- Real estate and vehicles

- Other valuable property you own

Don’t worry about being perfect on the first pass. Use your best current numbers—you can always refine them later.

3. List Your Liabilities

Next, enter all of your debts and obligations:

- Mortgages and home equity loans

- Auto loans and student loans

- Credit card balances

- Personal loans and any other outstanding debts

Be sure to include the current balance, interest rate, and minimum monthly payment whenever possible. This information will be very useful as you create your debt‑reduction plan.

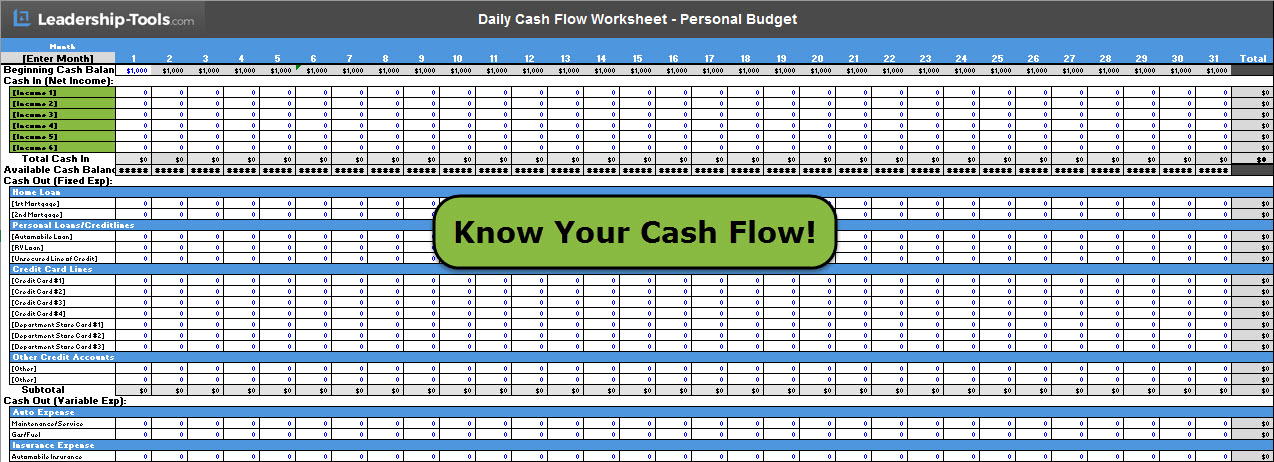

4. Capture Your Income and Expenses

Use the income and expense areas of the template to record:

- All regular income sources (paychecks, side income, benefits, etc.)

- Your main monthly expenses (housing, utilities, food, transportation, insurance, and so on)

This gives you a practical view of your cash flow—how much is coming in, how much is going out, and where you might be able to free up extra money.

5. Review the Totals and Insights

Once you’ve filled in the template, review your totals:

- Your total assets

- Your total liabilities

- Your current net worth (assets minus liabilities)

For many people, this is a powerful wake‑up call, and the perfect starting point for positive change. You’ll quickly see which debts are costing you the most, where you may be overextended, and where you have opportunities to save or invest more.

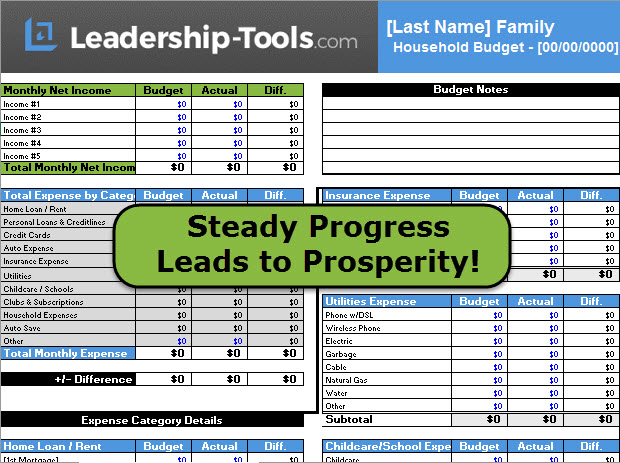

By taking a thorough inventory using our Personal Financial Statement template, you lay the foundation for smarter money management. In our 10 Steps to Conquer Debt system, this inventory becomes the roadmap you’ll use to prioritize debts, set realistic goals, and track your progress over time.

How to Complete a Personal Financial Statement

Once you’ve gathered your information and started using the template, a few simple best practices will ensure your Personal Financial Statement is accurate, useful, and easy to keep up-to-date.

Follow these guidelines as you complete your statement:

1. Choose A Specific “As Of” Date

Decide on a single date that your numbers represent (for example, “As of March 31, 2026”).

Use that same date for all balances so your assets, liabilities, income, and expenses reflect one consistent point in time.

2. Use Realistic, Documented Values

Whenever possible, base your entries on actual statements, not guesses.

- For bank accounts and debts, use current statement balances.

- For investments, use recent market values.

- For physical assets (home, car, etc.), use conservative estimates, not inflated “wishful thinking” numbers.

Realistic values give you a true starting point and help you measure real progress over time.

3. Separate Personal from Business Finances

If you own a business, keep your personal financial statement focused on your personal finances.

- Include your ownership interest in the business as an asset.

- Keep day‑to‑day business income/expenses on separate business records.

This keeps your personal picture clear and makes it easier for lenders, advisors, and partners to understand your situation.

4. Classify Assets and Debts Correctly

Take a moment to place each item in the right category:

- Short‑term assets: cash, checking, savings

- Long‑term assets: retirement accounts, investments, real estate

- Short‑term debts: credit cards, small personal loans

- Long‑term debts: mortgage, auto loans, student loans

Accurate classification helps you see how liquid (accessible) your resources are and how heavy your long‑term obligations may be.

"Make a decision to be successful right now. Most people never decide to be wealthy and that is why they retire poor."

- Brian Tracy

5. Double‑Check for Missing Items and Duplicates

As you enter data, ask yourself:

- “Am I missing any account, card, or loan?”

- “Have I counted any asset or debt twice?”

It’s common to overlook an old card, a store account, or a small loan. Take the time to catch these now so your statement is truly complete.

6. Pay Attention to Key Indicators, Not Just Totals

Your Personal Financial Statement is more than a list; it’s a decision‑making tool. As you review it, note:

- Your net worth (assets minus liabilities)

- How much of your debt is high‑interest (such as credit cards)

- How much of your monthly income is already committed to fixed payments

These insights will guide your priorities as you work to reduce debt, increase savings, and strengthen your overall financial position.

7. Update Your Statement on a Regular Schedule

A one‑time snapshot is helpful, but real progress shows up over time.

- Choose a regular update schedule (monthly or quarterly works well).

- Save each version so you can compare and see your net worth grow and your debts shrink.

When you complete your Personal Financial Statement carefully and review it regularly, you gain a level of clarity that most people never achieve. That clarity becomes the foundation for our 10 Steps to Conquer Debt process and every major money decision you make going forward.

Completed Example (with Lender-Style Notes)

Examples remove uncertainty. Below is a simplified example showing how a completed personal financial statement might look. Your numbers will differ, but the structure is what matters: clear categories, current balances, and values you can support with documentation.

Example Snapshot (As of: [Month Day, Year])

Assets (Examples)

Cash (checking + savings): $18,500

- Lender note: This should match your latest bank statements. Avoid rounding up “because it’s close.”

Retirement accounts (401(k), IRA): $92,000

- Lender note: Use the current statement value. If your plan has restrictions, be prepared to explain them.

Brokerage/investments: $26,000

- Lender note: List liquid investments separately from retirement when possible—liquidity matters.

Primary residence (estimated market value): $385,000

- Lender note: A reasonable estimate is fine unless the lender requires an appraisal. Don’t ignore selling costs if asked for “net proceeds.”

Vehicle(s): $14,000

- Lender note: Use a realistic market value, not what you paid originally.

Business ownership interest: $60,000

- Lender note: Be conservative unless you can support a higher valuation. Expect follow-up questions.

Total Assets: $595,500

Liabilities (Examples)

Mortgage balance (primary residence): $248,000

- Lender note: Use the current payoff/balance from your mortgage statement (not original loan amount).

Credit cards (total): $6,400

- Lender note: Don’t omit cards you “pay off monthly.” Lenders still want current balances and minimum payments.

Auto loan balance: $7,800

- Lender note: Include the monthly payment; it affects debt-to-income.

Student loans: $12,500

- Lender note: Ensure this matches your latest loan dashboard/statement.

Taxes payable/payment plans: $0

- Lender note: If you owe back taxes or are on a payment plan, disclose it—this is a common underwriting tripwire.

Contingent liability (personal guarantee on business line of credit): $25,000

- Lender note: Guarantees matter even if the business is currently paying. Disclose co-signed/guaranteed obligations.

Total Liabilities: $299,700

Net Worth (Total Assets – Total Liabilities): $295,800

Income & Expense Example (Monthly)

Gross monthly income: $8,200

Other income (rental/side income): $600

Total monthly debt payments (mortgage + auto + student + cards): $2,450

- Lender note: If you’re using this for a loan application, consistency between this number and your credit report matters more than perfection.

Common “Red Flag” Fixes Before You Submit

- Add an as-of date and keep it consistent across all totals.

- If a number is estimated (like real estate or business value), note the method you used.

- Don’t hide debts that are “almost paid off.” Lenders still count obligations.

- If you co-signed or guaranteed something, treat it as disclosable—even if you’re not making payments today.

Keeping the example in mind, you can quickly see how to calculate your current Net Worth and understand how to influence the balance by increasing Assets; decreasing Liabilities; or ideally, doing both at the same time.

Next, let’s make the template even more useful by avoiding a few common mistakes that can distort your net worth and your decisions.

Common Mistakes When Using a Personal Financial Statement Template (and How to Avoid Them)

Most problems with filling out a personal financial statement aren’t math problems, they’re classification issues. These quick checks help your personal financial statement stay accurate and useful, especially if you’re using it to guide debt payoff decisions or financial goal planning.

Mistake 1: Mixing “What You Own” with “What You Earn”

Assets are what you own (balances and values). Income is what you earn (cash flow). Keep them in their proper sections so your financial snapshot stays clean.

Mistake 2: Using Unrealistic Values (or avoiding estimates entirely)

Perfection isn’t required when filling in your initial values. Use reasonable estimates for items like a car or home value, and update later if needed.

Simple approach: note the source (e.g., “estimated via online valuation tool”).

Mistake 3: Forgetting Recurring Debts or “Small” Balances

Small debts add up and can change behavior. Include everything up front so your plan is based on reality.

Mistake 4: Updating Inconsistently (so you can’t see progress)

When updates are inconsistent, it’s hard to see real progress. Your numbers appear to "jump around" instead of showing a clear trend. Pick a cadence (monthly or quarterly) and stick to it. At the very least, you should be completing a personal financial statement on an annual basis to ensure you are making solid progress in your financial life.

By avoiding these common errors, your personal financial statement will provide you with a reliable dashboard, not just a one-time worksheet. Next, let’s connect it to why it matters for leadership, focus, and personal momentum.

Why a Personal Financial Statement Matters (Especially for Leaders and Solopreneurs)

When you take the time to complete a Personal Financial Statement, you’re doing far more than filling out a form. You’re giving yourself clarity, control, and the ability to respond wisely to whatever life sends your way.

Once you have all of your key financial information on one sheet, you are no longer in the dark about your money. You’ll always know where you stand.

Our personal financial statement template helps you replace vague worry about your financial condition with specific knowledge, which helps you to lead yourself better, plan more clearly, and make decisions that match your desired outcome.

The following provide several powerful reasons to complete a Personal Financial Statement:

1. Protection in a Crisis

If your identification is ever stolen, or you need to react quickly to a financial emergency, having a current Personal Financial Statement becomes invaluable.

With all of your account numbers, balances, and creditor contact information organized in one place, you can immediately contact your banks and credit card companies to close accounts, re‑issue cards, and limit any damage.

This benefit alone makes maintaining a Personal Financial Statement worth your time.

2. Confidence and a Sense of Control

"He who will not economize will have to agonize."

- Confucius

Most people feel stressed about money because they don’t really know their true financial position. Once you see everything clearly on a single page, that anxiety begins to fade.

You gain confidence knowing that you are facing reality and taking responsibility for your financial destiny. Instead of avoiding the numbers, you’re leading yourself through them.

3. Better, More Thoughtful Decisions

When you have a complete picture of your assets, debts, income, and expenses, you can make decisions based on facts instead of guesswork.

You’ll be better prepared to:

- Evaluate new opportunities

- Decide which debts to attack first

- Set realistic savings and investment goals

- Talk with lenders, advisors, or family members about your situation

A clear Personal Financial Statement becomes a self-leadership tool that helps you pause, think, and choose wisely instead of reacting on emotion.

4. Turning Failure into Fuel for Success

If you’re deep in debt, it’s easy to feel like a failure. But being in debt is not who you are – it’s simply a result of past choices and circumstances.

The difference between people who stay stuck and those who turn things around is how they respond to setback:

- The unsuccessful person lets failure define them, avoids the truth, and repeats the same mistakes.

- The successful person studies what went wrong, accepts responsibility, and takes new, better actions.

Completing a Personal Financial Statement is a powerful act of self‑leadership. You are choosing to look at the truth, learn from it, and use that knowledge to build a better future. Our Personal Financial Statement template helps you identify financial shortcomings, understand what led you there, and create a clear plan to move forward.

5. A Foundation for Long‑Term Change

The purpose of completing a Personal Financial Statement is simple:

- To give you the knowledge you need to manage your money wisely

- To expand your ability to overcome financial challenges

- To improve the overall condition of your life

As you work through this process, you’re practicing self‑leadership: taking ownership, making conscious choices, and guiding yourself toward your goals.

Combined with our other self-leadership tools and our “10 Steps to Conquer Debt” system, your Personal Financial Statement becomes the foundation for conquering debt, increasing your income, and changing the financial future of your family for years to come.

Using This for a Loan? (SBA Form 413 + Bank Requirements)

f you’re searching for a personal financial statement template because a lender requested it, you’re not alone. Many banks (and lenders involved in SBA-related financing) ask for a personal financial statement to confirm your overall net worth, liquidity, and monthly obligations.

Important: Some lenders require their own personal financial statement form, or they may specifically request SBA Form 413 (Personal Financial Statement). If your lender provides a form, use theirs. If they do not, this template is a strong starting point because it captures the same core categories lenders review.

How This Template Maps to Typical Lender Forms (Including SBA Form 413)

Most lender versions (including SBA Form 413) look for the same information:

- Assets: cash, retirement accounts, brokerage accounts, real estate, vehicles, business ownership, other assets

- Liabilities: mortgages, installment loans, credit cards, personal loans, taxes payable, other debts

- Net worth: total assets minus total liabilities

- Income and expenses: monthly or annual totals (varies by lender)

- Contingent liabilities: co-signed debts, guarantees, pending tax obligations, legal judgments (if applicable)

What Lenders Commonly Look For (Quick Pass/Fail Checks)

Before submitting your personal financial statement form, quickly verify:

- You included an “as of” date (lenders treat this as a snapshot in time).

- Values are realistic and documentable (statements, payoff letters, reasonable estimates).

- Debts show current balances (not original amounts), and credit card totals aren’t missing.

- Real estate includes the property, current estimated value, mortgage balance, and payment.

- You disclosed anything you’re personally guaranteeing (business loans, co-signed notes).

If Your Lender Mentions “SBA Form 413”

If your lender specifically asks for SBA Form 413, you should complete that exact form. You can still use our personal financial statement template to gather your numbers first and file for future reference, then transfer the totals into the SBA document to reduce errors and speed up completion of the loan process.

FAQs: Personal Financial Statement Template

These are the questions people commonly ask when downloading a personal financial statement template for the first time. Use them to confirm you’re filling it out correctly and consistently.

What is a personal financial statement?

A personal financial statement is a snapshot of your finances on a specific date. It lists your assets, liabilities, and net worth, and sometimes includes income and expenses.

Is a personal financial statement the same as a balance sheet?

They are similar in structure, but not the same in typical usage. A balance sheet is usually a business financial statement. A personal financial statement (or personal net worth statement) is the individual/household version.

How often should I update my personal financial statement?

Monthly if you’re actively paying down debt or building savings, quarterly if your finances are stable, and any time before major financial decisions.

Should I include my home and mortgage?

Yes. If you include the home value as an asset, include the mortgage balance as a liability so your net worth remains meaningful.

Should I include my small business as an asset?

If your business has measurable value and you can estimate it responsibly, you can include it as an asset (with a note explaining your estimate). If you’re unsure, it’s okay to exclude it and keep your personal financial statement conservative.

If you’re ready to turn this financial snapshot into action, we encourage you to download our free ebook, 10 Steps to Conquer Debt, along with our entire collection of personal finance statement templates.

Begin a journey of financial education that will lead to greater confidence in your decision making. Especially if your next goal is to reduce debt and build financial momentum.

Download 10 Steps to Conquer Debt eBook

Getting your financial affairs in order is just one step in our 10 Steps to Conquer Debt system. Download the free eBook today!

Gather your financial records and start filling out this free Personal Financial Statement Template: PDF | Excel File

To access all of our free leadership tools simply subscribe to our free newsletter. You will immediately receive a password that grants access to our entire leadership tools library.

Your privacy is important to us. We never share or sell email addresses.