- Home

- Leading Self

- Debt Payoff Planner Templates

- Cash Envelope System

Free Cash Envelope System Template (PDF/Excel/Sheets) + 5-Step Setup

Want a simple, hands-on way to control day-to-day spending so you can lead yourself with more discipline and less stress? This page gives you a free cash envelope system template (PDF/Excel/Sheets) plus a 5-step setup you can start this week to keep discretionary spending on track and redirect leftover cash toward your goals (like debt payoff or savings).

The goal is straightforward: control day-to-day spending categories (the ones most likely to drift), reduce financial stress, and redirect leftover cash toward bigger priorities like debt payoff, savings, or investing; without needing complex apps or spreadsheets.

In the prior step we introduced our household budget template, which allows you to create your monthly household budget. Most people would stop there and believe they had done all they could to ensure they would live within their means.

Learn step-by-step how easy it is to start using this powerful money management system today.

Quick Start (2–3 Minutes)

Print cash envelope templates and affix to the back of your envelopes.

2) Choose 5–8 envelope categories

Start simple (examples): Groceries, Gas, Dining Out, Household, Fun, Sinking Fund, Buffer.

3) Set your amounts and “stuff” the envelopes

Write the starting balance on each envelope/tracker and put the cash in.

4) Track every spend

Log each purchase immediately and update the remaining balance. When an envelope is empty, pause spending (or move money intentionally).

That’s it! The full setup steps, examples, and troubleshooting tips are below.

Jump To: Quick Start | Download Template | What Is the Cash Envelope System | Who Should Use It | How to Use | A Realistic Example | Hybrid Envelope Budgeting |Why This Matters | Create a Habit | Common Problem & Quick Fixes | 5 Core Rules for Success | FAQ | Next Steps | Download eBook

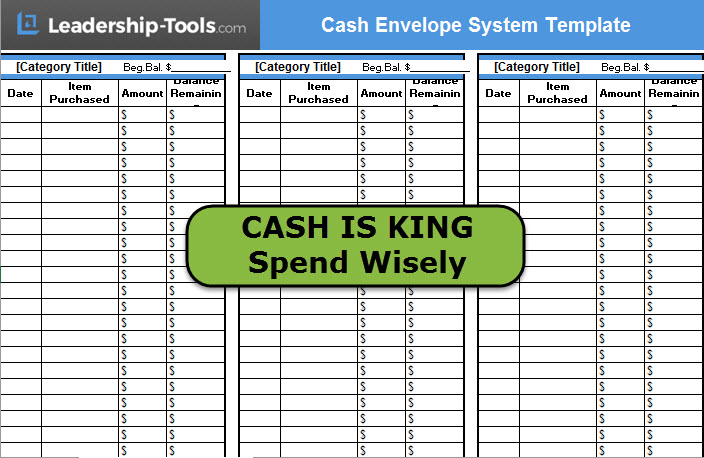

Free Cash Envelope System Template

To make this easy, we’ve created a free Cash Envelope System Template for you. If you want the envelope system to stick, you need something simple you’ll actually use consistently.

That’s what the template is for: it turns “good intentions” into a repeatable routine you can follow every week or every payday.

What you get with the template (free):

- Printable cash envelope system template (PDF): a simple envelope spending tracker you can attach to an envelope to record deposits and spending.

- Cash envelope tracker (Excel): track category balances digitally if you prefer to reconcile cash weekly.

- Quick-start instructions: the same 5-step setup in this guide, laid out clearly so you can start fast.

- Optional: “10 Steps to Conquer Debt” eBook (if you’re pairing envelopes with a debt payoff plan).

Ready to get started?

After printing off the desired number of cash envelope templates, simply staple, glue or tape the template to the back of each cash envelope.

You can use a regular white envelope or go to your bank and ask for a few extra Drive-Up cash envelopes.

Write the total amount of budgeted cash at the top of each template. As you make a purchase, keep a running total of how much cash is being spent.

Download the cash envelope budget template first, then come back here and follow the quick-start steps below. You’ll be set up in under an hour, and the weekly routine typically takes just a few minutes.

What Is the Cash Envelope System? (Simple Definition)

The cash envelope system is a budgeting method where you allocate cash to specific spending categories; knowing you must then stop spending in that category when the cash is gone. It replaces “I think we’re okay this month” with a clear, physical boundary that’s hard to ignore.

Definition:

The cash envelope system is a budgeting approach that uses labeled envelopes for spending categories (like groceries or dining out). You put a set amount of cash in each envelope and track spending so you don’t exceed your plan.

Why it works (especially for busy people):

- It makes trade-offs visible (spend here, save there).

- It reduces impulse purchases (cash creates a pause).

- It builds self-leadership habits: planning, discipline, and review.

Think of envelopes as “training wheels” for your budget. Once you can consistently stay within category limits, you can decide whether to keep using cash, switch to a hybrid system, or move to a digital approach with the same discipline.

Who the Envelope Method Works Best For (and Who Should Skip It)

The cash envelope system isn’t meant for every expense; and that’s actually its strength. When you use it for the right categories (the “easy-to-overspend” ones), it quickly tightens discretionary spending without making you feel deprived or forcing you to track every purchase across multiple apps.

Best for (ideal envelope categories):

- Groceries

- Dining out / coffee runs

- Gas / transportation

- Personal spending / fun money

- Household items (small purchases that add up)

- Kids’ activities (if spending is frequent)

Not ideal for (keep these digital or automated):

- Rent/mortgage

- Utilities

- Debt payments

- Insurance

- Subscriptions (better handled by reviewing and canceling, not cash)

If you share finances:

- Agree on category rules.

- Decide how you’ll handle “miscellaneous.”

- Choose one refill schedule (weekly or per-paycheck).

- Pick one tracking method (the printable tracker or the Excel tracker).

Use envelopes for the categories where habits can quietly sabotage your plan, such as frequent purchases and easy impulse spending. Keep your fixed bills on autopilot, so you’re not wasting willpower on decisions that don’t change month-to-month.

This way, you can focus your attention where it truly matters: the handful of everyday choices that create real momentum. Even small wins like staying within your grocery or dining-out envelope, add up fast and make it easier to hit bigger goals like debt payoff, savings, and long-term stability.

The 5-Step Quick Start (How to Set Up Your Envelopes)

In the previous step of the “10 Steps to Conquer Debt” system, you used our Household Budget Template to create your monthly budget. Most people stop there and hope they’ll stay “within the numbers” on a screen.

The cash envelope system is the next step that turns your written budget into daily behavior.

Use this 5‑step Quick‑Start Guide to get started now:

Step 1: Identify Your “Cash‑Friendly” Categories

Look at your household budget and highlight categories that are easy to pay in cash. If you’re unsure, pick the categories where you most often say, “Where did our money go?” Those are your first envelopes.

Typical choices include:

- Groceries

- Gas

- Clothing

- Entertainment

- Birthday / Holiday Gifts

- Charity / Donations

- “Mad Money” (small, guilt‑free spending)

The more you pay expenses through cash envelopes, the better – but keep it manageable to start. For example, start using the system with 3–5 envelopes, not 12.

Step 2: Decide How Much Cash Goes in Each Envelope

This is where your budget becomes real. Your numbers don’t need to be perfect, they just need to be intentional and based on what you can afford after bills and debt minimums.

For each category, decide: “How much can I reasonably spend this month and still hit my debt and savings goals?”

- Use your existing household budget as your guide

- Write the total amount at the top of each envelope template

- Example: Groceries – $500; Gas – $180; Entertainment – $80

Your first month is a test run. Your primary goal is to be honest and work the system. You’ll adjust next cycle with better information.

Step 3: Prepare, Withdraw, and “Stuff” Your Envelopes

Get your envelopes ready:

- Print your Cash Envelope System Templates

- Attach one template to the back of each envelope (regular white envelopes or free drive‑up envelopes from your bank work fine)

- Clearly write the category name and starting cash amount

Choose a refill cadence that matches your life. Most people do best with either weekly stuffing or per-paycheck stuffing.

Two simple refill options:

- Weekly: good for tighter control and faster habit-building.

- Per paycheck: good for predictable pay cycles and fewer bank runs.

- Security tip: only carry what you need for the week. Keep the rest at home in a secure spot.

Divide the money and “stuff” your envelopes according to your allocated monthly budget for each category. Consistency matters more than the exact day you withdraw cash. Pick a schedule you’ll actually follow.

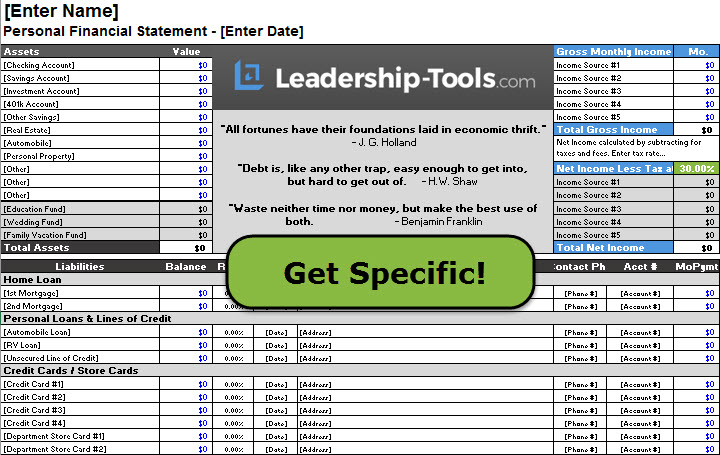

Step 4: Track Every Spend (Use the Template)

Tracking is what turns the envelope system into a system. Without tracking, envelopes become “guessing with cash.”

How to track (simple):

- Every time you add cash: write it as a deposit.

- Every time you spend: write it as an expense.

- Keep a running balance: so you can see what’s left instantly.

The cash envelope system template removes mental math. When you can see the balance at a glance, you make better decisions under pressure.

Step 5: Review Weekly and Adjust Monthly

You don’t need a perfect plan to manage money well; you need a simple repeatable process. When you take just 10 minutes each week to review your envelopes, you catch small problems early and avoid that end-of-month “Where did it all go?” surprise.

Weekly review questions:

- Which envelope ran low too early?

- Which envelope had money left?

- What triggered off-plan spending?

- What rule do we need to tighten (or loosen) next week?

This last rule is what makes the system work. The envelope doesn’t negotiate with you. When it’s empty, you’ve hit your limit.

At month’s end:

- Celebrate any cash left over (use a small portion as a reward)

- Apply the bulk of leftover cash directly toward your debt reduction plan

Your first month is about learning. Your second month is about refining. That’s how you build a budget that lasts.

A Realistic Example: How Much to Put in Each Envelope

A common question is: “How much should I put in each envelope?” The best answer is based on your income, bills, and goals, but an example can make it easier to start.

Example Allocation (Per Paycheck)

Here’s a simple per-paycheck example using common categories. Adjust amounts up or down based on your situation.

Example (stuff twice per month):

- Groceries: $250 per paycheck (=$500/month)

- Gas: $90 per paycheck (=$180/month)

- Dining out: $60 per paycheck (=$120/month)

- Fun money: $40 per paycheck (=$80/month)

- Household items: $35 per paycheck (=$70/month)

If you’re working on debt payoff, the envelope system helps you “find money” by reducing the categories that quietly expand. The leftovers can become a predictable extra payment.

"There's nothing wrong with cash, it gives you time to think."

- Robert Pretcher Jr.

Hybrid Envelope Budgeting: Online Bills, Debit Cards, and Real Life

You don’t have to go “all cash” to benefit from the envelope method. In fact, most people do best with a hybrid system: cash for frequent discretionary spending and digital payments for fixed bills.

Keep Fixed Bills Digital (and Boring)

The envelope system shines with variable categories, not so much with fixed obligations.

What to keep digital:

- Rent/mortgage

- Utilities

- Insurance

- Minimum debt payments

- Subscriptions (manage these by canceling/negotiating, not cash)

Let automation handle what’s predictable. Use envelopes where behavior and your optional spending choices matter most.

Handling Online Purchases Without Breaking the System

Online spending is the easiest way to “accidentally” break the envelope rules. The fix is to create a clear process you’ll follow every time.

Two workable options:

Option A (cash-first):

- Take the cash out of the envelope.

- Set it aside in a “pending online purchases” mini-envelope.

- Place the order.

Option B (weekly reconcile):

- Use a dedicated card for discretionary spending.

- Record the purchase immediately on the envelope tracker.

- Remove the matching cash during your weekly review.

The goal is consistency. Choose one process and stick to it so your envelopes remain truthful.

Why This Money Management System Matters

“CASH (a tangible item of value that can be seen and held) is typically harder for people to part with – as opposed to quickly swiping a thin piece of plastic to make a purchase.”

When you pay with cash:

- You feel the trade‑off. Handing over bills makes you pause and ask, “Is this worth it?”

- You become more aware. Seeing the balance drop on the envelope keeps your budget front‑and‑center.

- You gain respect for your money. Recording each purchase reinforces that every dollar represents your time and effort.

"Happiness is a positive cash flow."

- Fred Adler

Most budgets fail not because people can’t add up the numbers, but because there’s no daily system that connects their intentions to their actions. The cash envelope method solves that.

Key reasons this system works:

- It enforces limits automatically

- It replaces vague “I’ll try to spend less” with concrete “I have $X left in this envelope”

- It helps prevent impulse spending and “small leaks” that quietly wreck your month

- It makes progress visible: when you have cash left over, you see and feel the win

In short, the cash envelope system is a simple behavior‑change tool disguised as a budget helper.

Create a Habit for Money Management Success

At first, using the cash envelope system can feel awkward and even inconvenient. That’s normal. Any new habit requires a bit of friction at the start.

Use these habit‑building tips for the first 3–4 months:

1. Commit to a Trial Period

Promise yourself you’ll use the system consistently for at least two full months before deciding whether to keep it. The first few weeks are about learning and adjusting.

2. Make It Part of Your Daily Routine

Every payday, follow the same steps in the process:

- Update your household budget

- Withdraw the amount of cash you'll need until the next payday

- Stuff your labeled envelopes with the budgeted cash amount

- Place the envelopes in your designated safe spot

3. Keep Things Simple

Start with a small number of categories (3–5 envelopes)

- Use round numbers that are easy to track

- Schedule 5–10 minutes once a week to review balances and make small adjustments

4. Adapt to Modern Realities (cards and online bills)

Not every expense can be paid in cash, and that’s okay.

Use envelopes where they make the most impact:

- Every day “in‑person” spending (groceries, gas, dining out, etc.)

- Discretionary purchases (fun money, entertainment, non‑essential shopping)

Fixed bills (rent, utilities, insurance) can remain on auto‑pay or electronic bill pay – they’re controlled in your written budget. The envelopes are for the area's most likely to “creep up” on you.

5. Turn Leftover Cash into Extra Motivation

Over time, challenge yourself: “How much cash can I have left in each envelope by month’s end?”

- Use a small amount to reward yourself

- Apply the majority directly to your debt balance

The more you practice this system, the less “work” it feels like. Instead, it becomes a routine that quietly protects your finances every single day.

Common Problems (and Quick Fixes)

Most envelope systems fail for a small number of predictable reasons.

The good news: each has a simple fix; usually a rule, a routine, or a smaller set of categories.

“My envelope ran out early.”

This usually means the category amount is too low, the refill cadence is too slow, or spending isn’t being tracked consistently.

Quick fixes:

- Switch to weekly refills for tighter control.

- Reduce the number of categories (start simpler).

- Use a “pause rule”: when the envelope is empty, you must wait 24 hours before buying.

- Adjust next month’s allocation based on reality.

Conclusion:

Running out early isn’t failure, it’s feedback. Use it to tighten your plan, not abandon it.

“I keep borrowing from other envelopes.”

Borrowing quietly destroys the system because it hides the trade-off.

Quick fixes:

- Add a clear rule: “No borrowing. If we choose to spend, we must choose where it comes from.”

- If you must move money, write it down as a transfer (so the trade-off is visible).

- Limit “miscellaneous” to a small amount so it doesn’t become a loophole.

Conclusion:

Your envelope rules should protect future you from stressed-out you. Keep them simple and enforceable.

“I’m worried about carrying cash.”

Security matters. You can still use the envelope method without carrying the full month’s cash.

Safer approach:

- Carry only one week of cash.

- Keep the rest secured at home.

- Consider a small envelope wallet/binder that stays out of sight.

- If safety is a serious concern, use the hybrid method + Excel tracker.

Conclusion:

The method is meant to reduce stress, not create it. Adjust the process so it fits your environment.

Rules of the Envelope System (Keep It Simple)

A few clear rules make the envelope system feel easy because when using cash, you either have it available or you don't. You never have to debate with yourself in the moment.

The 5 Core Rules

These are the rules that keep the system clean and effective.

Rules:

- Fund envelopes on a schedule (weekly or per paycheck).

- Track every spend (immediately or same day).

- When an envelope is empty, spending stops.

- No borrowing, unless you record it clearly as a trade-off.

- Leftover cash goes to a purpose (debt, savings, sinking fund).

Rules reduce decision fatigue. Once your rules are set, the system runs on habit, not willpower.

Frequently Asked Questions (FAQ)

These are the most common questions people have when starting a cash envelope system template; especially if they’re balancing modern digital spending with old-school cash.

Do I need to use cash for everything?

No. Most people use cash for variable categories and keep fixed bills digital. Use cash where it changes behavior. Keep the rest simple and automated.

How many envelopes should I start with?

Start with 5–8 envelopes. More isn’t better; consistency is better. Once you’re consistent for a month, add categories only if it truly improves clarity.

What do I do with leftover money in an envelope?

You have three good options: roll it over, move it to savings, or apply it to debt. The best choice depends on your goal. If debt payoff is your priority, sending leftovers to debt creates fast momentum.

Can I do “cash stuffing” with a debit card?

Yes, use a hybrid approach. Track card purchases against the envelope category and remove matching cash during your weekly review. The system still works as long as you keep the envelope balance truthful and updated.

How often should I refill envelopes?

Weekly and per-paycheck are the most common options. Choose the schedule you’ll follow reliably. Consistency beats optimization.

Next Steps: Debt Payoff + More “Leading Self” Tools

The envelope method is powerful on its own, but it’s even stronger when you pair it with a clear goal, like debt reduction.

The Cash Envelope System is one strategic piece of the larger plan you receive in our free eBook, “10 Steps to Conquer Debt.”

Here’s how it fits into the overall system:

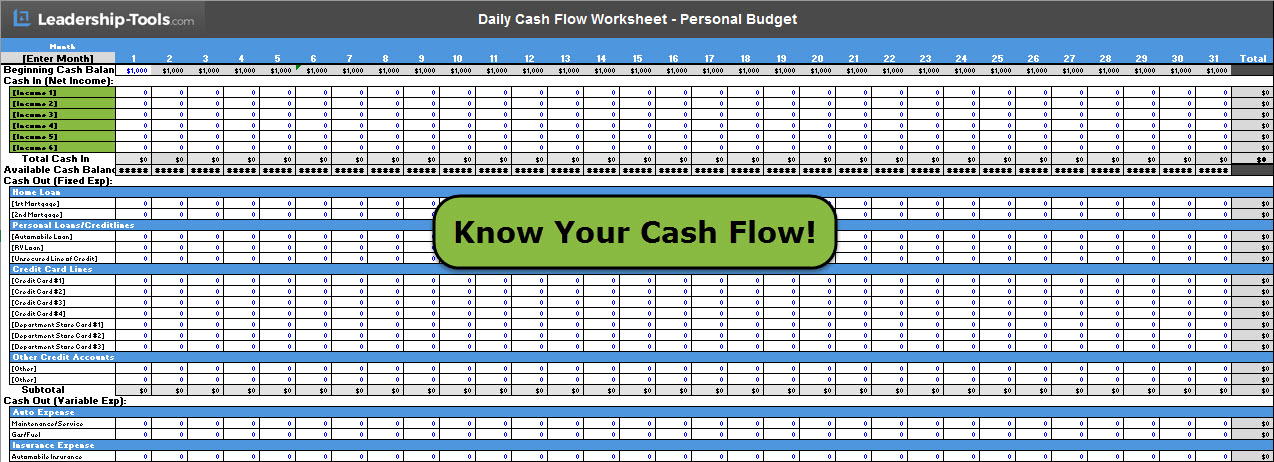

Earlier Steps Help You Get Organized: You learn to organize your financial records, understand your net worth, and create your monthly household budget using our other tools (Financial Record Labels, Personal Financial Statement, Household Budget Template, Daily Cash Flow Tool, etc.).

The Household Budget Establishes Your Plan: You decide, on paper, how much will go toward living expenses, debt, and savings. This is where most people stop – and where many budgets silently fail.

The Cash Envelope System Turns Your Plan into Daily Behavior: This page – and the Cash Envelope System Template – sits right in the middle of the process. It takes the numbers from your household budget and builds a simple, real‑world system for sticking to them.

The Extra Cash Fuels Faster Debt Reduction: When you consistently come in under budget in your envelope categories, you free up cash that can be applied to your debt. This accelerates the steps that follow in the “10 Steps to Conquer Debt” plan.

Download 10 Steps to Conquer Debt eBook

Choose a few key categories and follow the 5-step setup. Within one month, you’ll have real data, better habits, and a clearer path to your goals; whether that’s debt freedom, savings, or simply feeling in control again.

To access all of our free leadership tools simply subscribe to our free Leadership Tools newsletter. You will immediately receive a password that grants access to our entire leadership tools library.

Your privacy is important to us. We never share or sell email addresses.