- Home

- Leading Self

- 10 Steps to Conquer Debt

- Financial Statement Template

Personal Financial Statement Template for Money Management

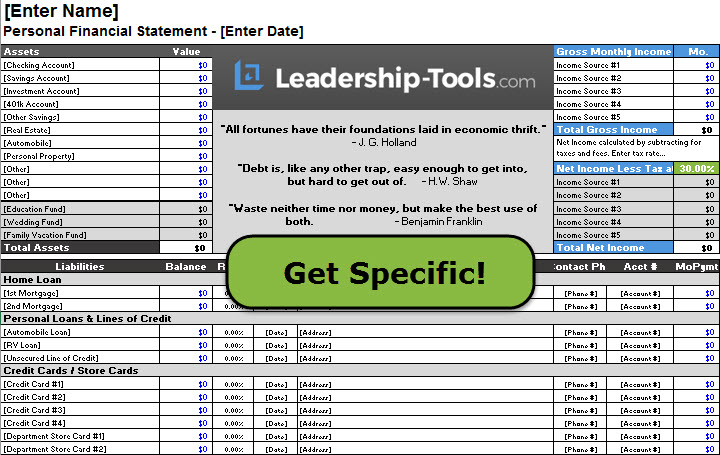

Our personal financial statement template is free and one of the most powerful tools you can use to get control of your money. It gives you a clear snapshot of what you own, what you owe, and where you stand today so you can make smarter decisions about debt, savings, and long‑term goals.

In Step Three of our free 10 Steps to Conquer Debt eBook , you will complete our free Personal Financial Statement template: PDF | Excel File

Whether you’re applying for a loan, creating a debt‑reduction plan, or simply want to understand your true net worth, this template will help you see your full financial picture on a single, organized page.

A personal financial statement is a snapshot of your financial health - assets, liabilities, and net worth. Knowing exactly where you stand reduces stress and frees mental energy for better leadership decisions. Use this free template to get clear fast.

With this free personal financial statement template, you can:

- List all of your assets and liabilities in one place

- Calculate your net worth quickly and accurately

- Spot problem areas, such as high-interest debt or underused assets

- Track your progress as you pay down debt and build savings over time

Our free template provides more than a simple financial statement. We have created a unique format for organizing your financial information, which makes this a more valuable tool - more on that in a minute.

"Your net worth to the world is usually determined by what remains after your bad habits are subtracted from your good ones."

- Benjamin Franklin

Think of your financial statement as a snapshot in time. Only at the time you complete the form are the values you write down 100% accurate.

For example, balances in various accounts can change daily so it is important that you update your personal financial statement monthly to track your progress. Each time you update our financial statement template, compare it to the prior month's statement to learn if you are moving in the right direction or not.

The most common obstacle people face in completing this step is... DENIAL.

People simply don't want to admit that their financial troubles are as bad as they really are. These people know deep-down that if they complete the process of accounting for every dime of income and debt, they will finally have to face the truth about their poor spending habits.

NO MORE DOUBTS, FEARS, WORRY or DENIAL.

If you want your money problems to change; if you truly want financial help; if you wish to learn effective budgeting guidelines - then it's time to face your fears, right here and right now.

Now is the time to get clear and specific about your financial condition.

Download Our Free Personal Financial Statement Template

Before you can improve your finances, you must first see your complete financial picture. That’s exactly what our Personal Financial Statement template helps you do. In one place, you’ll list everything you own and everything you owe so you can clearly understand where you stand today.

This free tool is part of our Leadership Tools library, which is available exclusively to subscribers of our free Leadership Tools Newsletter. However, for your convenience you can also download the template right here: PDF | Excel File

Take Inventory of Your Finances in 5 Simple Steps

Getting a clear picture of your finances is one of the most powerful steps you can take toward financial freedom and stronger self-leadership.

When you know exactly where you stand, money stops feeling overwhelming. You gain control, reduce stress, and free up mental energy for what matters most.

These 5 simple steps will help you complete your Personal Financial Statement quickly and confidently. No complicated math, just honest numbers and a clear template.

Once you finish, you’ll see your full financial snapshot: assets, liabilities, net worth, income, and expenses. That clarity becomes your roadmap for smarter decisions and faster progress.

Ready to start? Let’s go - one step at a time.

1. Gather Key Documents

Collect your most recent statements and financial records, including:

- Checking and savings accounts

- Investment and retirement accounts (401(k), IRA, etc.)

- Mortgage and home equity loans

- Auto loans and other personal loans

- Credit card statements

- Insurance policies

- Any other significant assets or debts

2. List Your Assets

Open the template and start by entering all of your assets:

- Cash in bank accounts

- Investment and retirement balances

- Real estate and vehicles

- Other valuable property you own

Don’t worry about being perfect on the first pass. Use your best current numbers—you can always refine them later.

3. List Your Liabilities

Next, enter all of your debts and obligations:

- Mortgages and home equity loans

- Auto loans and student loans

- Credit card balances

- Personal loans and any other outstanding debts

Be sure to include the current balance, interest rate, and minimum monthly payment whenever possible. This information will be very useful as you create your debt‑reduction plan.

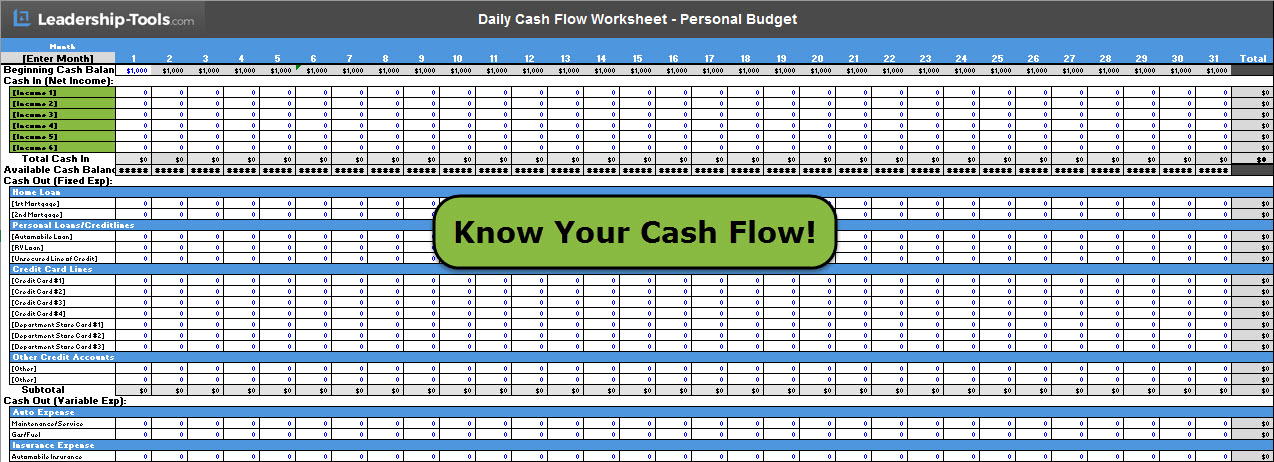

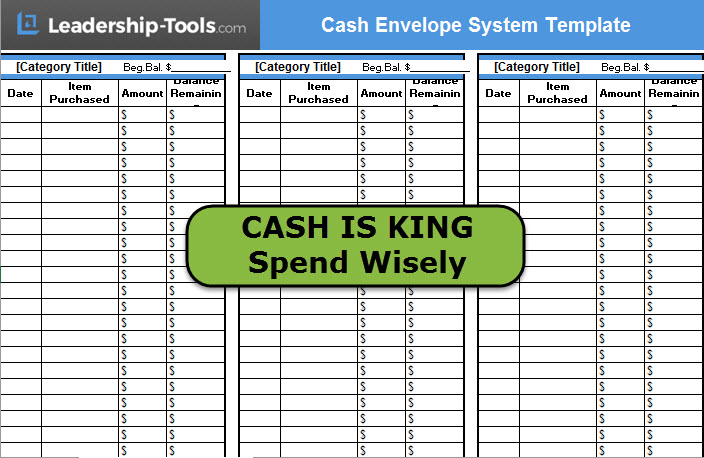

4. Capture Your Income and Expenses

Use the income and expense areas of the template to record:

- All regular income sources (paychecks, side income, benefits, etc.)

- Your main monthly expenses (housing, utilities, food, transportation, insurance, and so on)

This gives you a practical view of your cash flow—how much is coming in, how much is going out, and where you might be able to free up extra money.

5. Review the Totals and Insights

- Once you’ve filled in the template, review your totals:

- Your total assets

- Your total liabilities

- Your current net worth (assets minus liabilities)

For many people, this is a powerful wake‑up call, and the perfect starting point for positive change. You’ll quickly see which debts are costing you the most, where you may be overextended, and where you have opportunities to save or invest more.

By taking a thorough inventory using our Personal Financial Statement template, you lay the foundation for smarter money management. In our 10 Steps to Conquer Debt system, this inventory becomes the roadmap you’ll use to prioritize debts, set realistic goals, and track your progress over time.

How to Complete a Personal Financial Statement

Once you’ve gathered your information and started using the template, a few simple best practices will ensure your Personal Financial Statement is accurate, useful, and easy to keep up-to-date.

Follow these guidelines as you complete your statement:

1. Choose A Specific “As Of” Date

Decide on a single date that your numbers represent (for example, “As of March 31, 2026”).

Use that same date for all balances so your assets, liabilities, income, and expenses reflect one consistent point in time.

2. Use Realistic, Documented Values

Whenever possible, base your entries on actual statements, not guesses.

- For bank accounts and debts, use current statement balances.

- For investments, use recent market values.

- For physical assets (home, car, etc.), use conservative estimates, not inflated “wishful thinking” numbers.

Realistic values give you a true starting point and help you measure real progress over time.

3. Separate Personal from Business Finances

If you own a business, keep your personal financial statement focused on your personal finances.

- Include your ownership interest in the business as an asset.

- Keep day‑to‑day business income/expenses on separate business records.

This keeps your personal picture clear and makes it easier for lenders, advisors, and partners to understand your situation.

4. Classify Assets and Debts Correctly

Take a moment to place each item in the right category:

- Short‑term assets: cash, checking, savings

- Long‑term assets: retirement accounts, investments, real estate

- Short‑term debts: credit cards, small personal loans

- Long‑term debts: mortgage, auto loans, student loans

Accurate classification helps you see how liquid (accessible) your resources are and how heavy your long‑term obligations may be.

"Make a decision to be successful right now. Most people never decide to be wealthy and that is why they retire poor."

- Brian Tracy

5. Double‑Check for Missing Items and Duplicates

As you enter data, ask yourself:

- “Am I missing any account, card, or loan?”

- “Have I counted any asset or debt twice?”

It’s common to overlook an old card, a store account, or a small loan. Take the time to catch these now so your statement is truly complete.

6. Pay Attention to Key Indicators, Not Just Totals

Your Personal Financial Statement is more than a list; it’s a decision‑making tool. As you review it, note:

- Your net worth (assets minus liabilities)

- How much of your debt is high‑interest (such as credit cards)

- How much of your monthly income is already committed to fixed payments

These insights will guide your priorities as you work to reduce debt, increase savings, and strengthen your overall financial position.

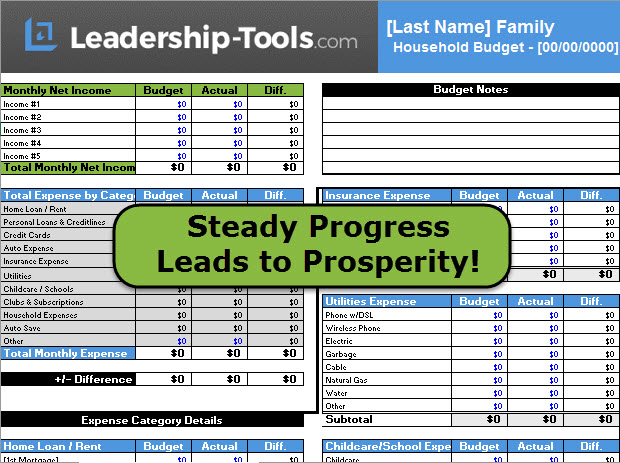

7. Update Your Statement on a Regular Schedule

A one‑time snapshot is helpful, but real progress shows up over time.

- Choose a regular update schedule (monthly or quarterly works well).

- Save each version so you can compare and see your net worth grow and your debts shrink.

When you complete your Personal Financial Statement carefully and review it regularly, you gain a level of clarity that most people never achieve. That clarity becomes the foundation for our 10 Steps to Conquer Debt process and every major money decision you make going forward.

Why Complete a Personal Financial Statement

When you take the time to complete a Personal Financial Statement, you’re doing far more than filling out a form. You’re giving yourself clarity, control, and the ability to respond wisely to whatever life sends your way.

Once you have all of your key financial information on one sheet, you are no longer in the dark about your money. You’ll always know where you stand.

There are several powerful reasons to complete a Personal Financial Statement:

1. Protection in a Crisis

If your identification is ever stolen, or you need to react quickly to a financial emergency, having a current Personal Financial Statement becomes invaluable.

With all of your account numbers, balances, and creditor contact information organized in one place, you can immediately contact your banks and credit card companies to close accounts, re‑issue cards, and limit any damage.

This benefit alone makes maintaining a Personal Financial Statement worth your time.

2. Confidence and a Sense of Control

"He who will not economize will have to agonize."

- Confucius

Most people feel stressed about money because they don’t really know their true financial position. Once you see everything clearly on a single page, that anxiety begins to fade.

You gain confidence knowing that you are facing reality and taking responsibility for your financial destiny. Instead of avoiding the numbers, you’re leading yourself through them.

3. Better, More Thoughtful Decisions

When you have a complete picture of your assets, debts, income, and expenses, you can make decisions based on facts instead of guesswork.

You’ll be better prepared to:

- Evaluate new opportunities

- Decide which debts to attack first

- Set realistic savings and investment goals

- Talk with lenders, advisors, or family members about your situation

A clear Personal Financial Statement becomes a self-leadership tool that helps you pause, think, and choose wisely instead of reacting on emotion.

4. Turning Failure into Fuel for Success

If you’re deep in debt, it’s easy to feel like a failure. But being in debt is not who you are – it’s simply a result of past choices and circumstances.

The difference between people who stay stuck and those who turn things around is how they respond to setback:

- The unsuccessful person lets failure define them, avoids the truth, and repeats the same mistakes.

- The successful person studies what went wrong, accepts responsibility, and takes new, better actions.

Completing a Personal Financial Statement is a powerful act of self‑leadership. You are choosing to look at the truth, learn from it, and use that knowledge to build a better future. Our Personal Financial Statement template helps you identify financial shortcomings, understand what led you there, and create a clear plan to move forward.

5. A Foundation for Long‑Term Change

The purpose of completing a Personal Financial Statement is simple:

- To give you the knowledge you need to manage your money wisely

- To expand your ability to overcome financial challenges

- To improve the overall condition of your life

As you work through this process, you’re practicing self‑leadership: taking ownership, making conscious choices, and guiding yourself toward your goals.

Combined with our other self-leadership tools and our “10 Steps to Conquer Debt” system, your Personal Financial Statement becomes the foundation for conquering debt, increasing your income, and changing the financial future of your family for years to come.

Download 10 Steps to Conquer Debt eBook

Getting your financial affairs in order is just one step in our 10 Steps to Conquer Debt system. Download the free eBook today!

Gather your financial records and start filling out this free Personal Financial Statement Template: PDF | Excel File

To access all of our free leadership tools simply subscribe to our free newsletter. You will immediately receive a password that grants access to our entire leadership tools library.

Your privacy is important to us. We never share or sell email addresses.