- Home

- Leading Self

- Debt Payoff Planner Templates

- Daily Cash Flow Template

Daily Cash Flow Template for Money Management

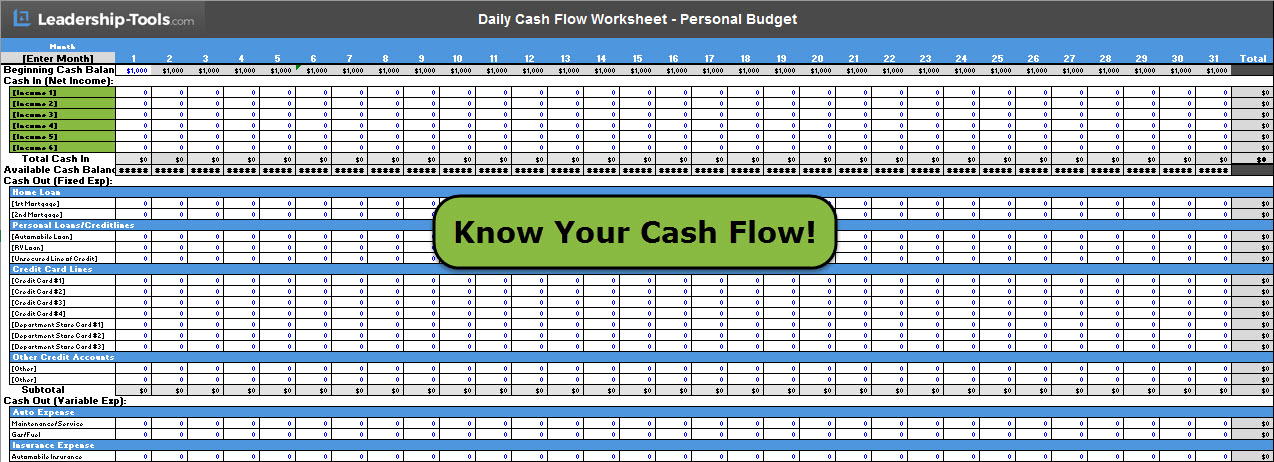

Our free daily cash flow template allows you to effectively manage your money by tracking the timing of all incoming revenue and outgoing expenses. This is one of several tools that are available as part of our free 10 Steps to Conquer Debt ebook.

Download Daily Cash Flow Template: PDF | Excel File

Instead of wondering, “Will I have enough to cover that bill?” you’ll be able to see, on paper, exactly how your cash moves in and out of your account each day – and lead your financial life with confidence.

In business, cash flow statements are used to manage the flow of cash coming in from sales and going out for expenses. The same idea works powerfully in your personal life.

You may already have a monthly budget, but you can still be caught off guard when a bill comes due a few days before your paycheck arrives. Medical bills, car repairs, weather damage, a broken window, a last‑minute school expense – these are all real‑life situations that can throw off your plan.

"If I had to run a company on three measures, those measures would be customer satisfaction, employee satisfaction and cash flow."

- Jack Welch

To manage these costs effectively, you must consider the timing of:

- When you receive your income, and

- When each bill is actually due.

Using our daily cash flow tool, you compare day‑by‑day cash coming in and going out. That’s what allows you to:

- Avoid late fees and overdrafts.

- Cover the basic needs of your household with confidence.

- Make smarter, proactive decisions about debt reduction and saving.

It’s not enough to complete a personal financial statement once and then file it away. Your net worth statement is only accurate on the day you complete it. Your daily cash flow tool, however, keeps you in touch with your money every single day.

Download Our Free Daily Cash Flow Template

You’re here for a daily cash flow template you can actually use, starting now. Start by downloading the format that fits your style: a daily cash flow spreadsheet for quick totals and calculations, or a printable daily cash flow worksheet if you prefer writing it down and updating it at the end of the day.

Choose Your Format

Download Daily Cash Flow template:

- Daily Cash Flow Spreadsheet (Excel File): Best if you want auto-totals and an easy way to edit categories.

- Printable Daily Cash Flow Worksheet (PDF): Best if you want a paper routine (wallet cash, receipts, notes).

What a Daily Cash Flow Template Is (and Who It’s For)

A daily cash flow template is a simple cash-in cash-out tracker that shows your real-time money position day by day. Instead of guessing whether you can afford something, you’ll know how much cash you have available, what changed today, and your ending balance. Knowing your cash flow allows you to make decisions based on reality, not just hope.

Who This Daily Cash Flow Tracker Helps Most

- Anyone living paycheck-to-paycheck (or close to it)

- People who get paid weekly, biweekly, irregularly, or via tips/commission

- Households juggling due dates (rent, utilities, subscriptions, debt payments)

- Solopreneurs who want a personal cash flow view separate from business accounting

- Anyone rebuilding finances and trying to stop “surprise” shortages

Daily Cash Flow vs. Budgeting (Why You Often Need Both)

- A budget is a plan (what you intend to do).

- Daily cash flow tracking is execution (what actually happened with your cash and how much you have right now).

Using both gives you control: the plan plus the daily reality-check.

If your biggest cash flow challenge is timing (bills landing before money arrives) this daily cash flow template is one of the fastest ways to regain control.

Most importantly, this isn’t about tracking every penny forever. It’s about building a lightweight daily habit that gives you confidence. After a week or two, you’ll start seeing patterns, like which days are consistently tight, which categories are quietly draining you, and how paydays and due dates interact. From there, you can make small, high-impact adjustments (moving a due date, setting a minimum balance buffer, reducing one recurring expense) that create real breathing room.

This daily cash flow template helps you turn “I hope I’ll be okay” into “I know what I can do next.”

What’s Inside the Template (Columns + Simple Formulas)

A daily cash flow template only works if it’s simple enough to use every day and clear enough to prevent mistakes. The purpose isn’t to create “perfect accounting” or overwhelm you with categories, it’s to give you a reliable snapshot of your cash position so you can make good decisions in real time.

The goal is clarity: you should be able to look at one day and instantly understand your cash position.

Core Columns (Recommended)

Date

The day you’re tracking. One row per day keeps things simple.

Beginning Cash (Starting Balance)

The amount of money you had at the start of the day. This might be your checking account balance, cash on hand, or a combined number. How ever you choose to define it, just be consistent.

Cash In (Inflows)

Money that comes in today (paycheck, transfer, cash deposit, reimbursement, side gig, tips).

Cash Out (Outflows)

Money that leaves today (groceries, fuel, bills, online purchases, transfers out, ATM withdrawals).

Notes / Category (Optional but Helpful)

A short label like “Rent,” “Gas,” “Groceries,” “Phone,” “Minimum payment,” “Refund,” etc. This makes patterns obvious.

Ending Cash (End-of-Day Balance)

This is your “truth number” at the end of the day.

The Simple Daily Cash Flow Formula

If you’re using the spreadsheet version, the core calculation is:

Ending Cash = Beginning Cash + Total Cash In − Total Cash Out

If you have several transactions in a day, the process is the same - you just add up all the day’s money in and all the day’s money out, then record the totals.

Category Guidance (Keep It Practical)

If you’re not sure what to track daily, start with these:

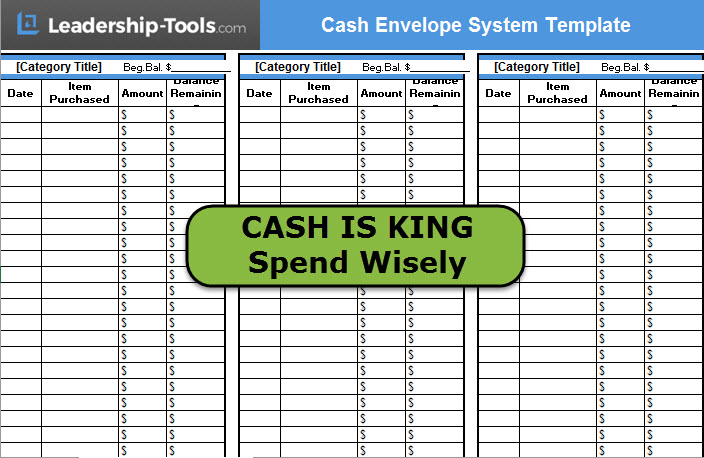

- Track daily: food, fuel/transportation, discretionary spending, small purchases that add up fast

- Track on the due date: rent/mortgage, utilities, subscriptions, debt payments

- Track immediately: any purchase or bill that could trigger overdraft risk

When your template makes the math and the categories obvious, you reduce stress and prevent “where did it go?” moments. Instead of guessing, you can quickly see what you started with, what changed today, and what you truly have left.

Clear categories also remove emotion from decisions. After a few days, patterns show up fast. For example, forgotten subscriptions, small “quick stops” that add up, and the days your spending spikes.

With that clarity, your next step becomes simpler: pause a purchase, adjust a due date, or build a small buffer. That’s how daily tracking turns into real control.

How to Use the Daily Cash Flow Template (Step-by-Step)

This is the simplest process that still produces real control. If you can update your daily cash flow template once per day, you’ll quickly spot problems before they become emergencies.

Once you download the daily cash flow template, follow these steps to put it to work:

1. Gather Your Information

Use the information you collected in your personal financial statement (income sources, regular bills, debt payments, due dates, etc.). If you haven’t created one yet, this is a great time to list all your income and expenses.

2. List All Income and Expected Deposits

Add every paycheck and other income source for the month. Note the date and the amount so you can see exactly when cash is coming into your account.

3. List All Bills and Planned Expenses

Write down every bill and regular expense you expect this month, along with the day it’s due and the amount you plan to pay. Include fixed bills (rent, utilities, loan payments) and flexible spending (groceries, fuel, etc.).

4. Map Cash In vs. Cash Out By Day

Use the template to plot, day by day, how much money is coming in and how much is going out. This allows you to “spend it on paper first” before you send a single dollar to anyone.

5. Watch Your Running Cash Balance

As you map income and expenses across the month, the template helps you see which days are tight and where you have more breathing room. If you see that you’re running out of cash before all of your bills are paid, you know you need to adjust.

6. Take Proactive Action with Creditors

When the numbers show that money will be short on a certain date, identify creditors who may be willing to work with you. Get on the phone, explain your situation honestly, and ask whether you can adjust the due date or make a smaller payment on that cycle. Many creditors appreciate responsible, proactive communication.

This daily cash flow template works best when it becomes a small daily habit—simple inputs, clear outputs, and a quick glance at tomorrow’s risks. This is part of being a responsible adult who is actively managing cash flow.

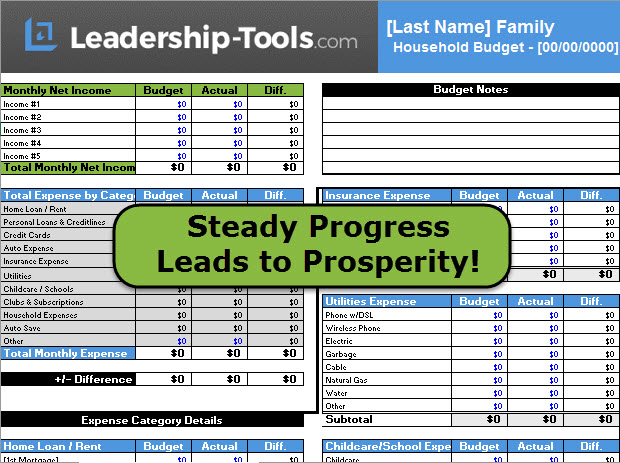

Use this personal budget worksheet and our other free tools to get started today.

Example: A Filled-In Day (So You Can Copy It)

A blank worksheet can feel intimidating. Here’s a realistic example of how a daily cash flow tracker might look when filled in, so you can mirror it in your own spreadsheet or printable sheet.

Sample Day (Example Only)

Date

- 2026-02-13

Beginning Cash

- $425.00

Cash In

- $0.00

Cash Out (Itemized)

- Groceries: $38.25

- Fuel: $22.00

- Prescription: $11.50

- Streaming subscription (auto-draft): $15.99

Total Cash Out

- $87.74

Ending Cash (Calculation)

- Ending Cash = 425.00 + 0.00 − 87.74 = $337.26

Notes

- “Subscription hit today; review auto-renewals this weekend.”

How to Use This Example

- If your outflows are mostly small daily purchases, itemize them (even for 7 days) to see patterns.

- If you already know your biggest categories, you can lump small purchases into one line like “Daily spending.”

When you can see a filled-in example, your daily cash flow template becomes a tool, not a chore, because you know exactly what “done” looks like.

Why Daily Cash Flow Management Matters

Using this tool, you can manage your cash flow with confidence, ensuring your bills are never late and that you’ll have money available to provide for the basic needs of your household.

Upon downloading the personal budget worksheet for managing your daily cash flow, use the information you've already collected if you've completed our personal financial statement tool and begin plotting the amount of income and expenditures for the upcoming month.

By writing down all your planned revenue and expenses for the month, you will effectively spend it all on paper first, before ever paying a single dollar out to anyone. This is called “planning for success".

If you completed the personal financial statement in full, the due dates are already known. Simply copy and enter the date that each payment is to be made per your available cash.

If you find yourself running out of cash, before all your bills are paid, identify creditors that will work with you, get on the phone, and negotiate a later due date. Don’t be embarrassed to ask for assistance. Be honest and explain your situation. You may be surprised at how many creditors are happy to work with you.

This is all part of being a responsible adult who is pro-actively managing cash flow. Use our daily cash flow template and other free tools to get on this today!

Daily Close: The 10-Minute Cash Flow Routine

The fastest way to get results is to “close” your money day the same way you’d close a cash register: capture what happened, confirm the ending number, and get ready for tomorrow. This routine keeps your daily cash flow spreadsheet accurate and your stress lower.

The Daily Cash Flow Close Checklist (10 Minutes)

- Collect receipts or open your transaction list (bank app, notes, wallet).

- Log all Cash In for the day (even small reimbursements).

- Log all Cash Out (card + cash + auto-drafts).

- Confirm anything that’s pending but likely to post (note it if needed).

- Total inflows and outflows.

- Calculate Ending Cash.

- Compare Ending Cash to your actual balance (quick reality check).

- Write one note: “What changed today?” (optional but powerful).

- Look at tomorrow: any known bills or expected income?

- Decide one small action if needed (delay a purchase, move money, cancel a subscription, plan groceries).

Make It Easier to Stick With

- Same time every day (right after dinner or before bed)

- Same place (desk, kitchen table)

- Same reward (peace of mind; fewer surprises)

A daily close routine turns the template into a system. Take pride in knowing you've taken the necessary steps to effectively know your daily cash flow, which will empower you to effectively manage your finances

Daily Cash Flow vs. Your Checkbook Register

As you begin using the daily cash flow template, it’s helpful to understand how it works alongside your checking account register:

- Your checkbook register shows how much money is available to spend right now.

- Your daily cash flow tool shows the bigger picture – what’s coming in, what’s going out, and what’s already “spoken for” in the days and weeks ahead.

Our daily cash flow template is the perfect tool to ensure that you always have the money you need, when you need it.

Use these two tools together:

- Refer to your checkbook to confirm your current bank balance.

- Refer to your cash flow template to decide what you can safely spend today while still meeting upcoming obligations.

When it comes to money, success is in the details. By tracking your daily cash flow, you take ownership of those details and lead your financial life instead of reacting to it.

"No one's ever achieved financial fitness with a January resolution that's abandoned by February."

- Suze Orman

Build Confidence Through Daily Habits

As you begin to direct your money with a clear purpose – not just once a month, but every single day – you’ll feel greater confidence in leading your financial life.

Some common benefits you’ll notice as you use the daily cash flow template:

"Just as a fisherman must watch the ebb and flow of the tides, an investor and businessperson must be keenly aware of the subtle shifts in cash flow."

- Robert Kiyosaki

- You spend more intentionally because you’re seeing the whole month, not just today.

- You catch potential shortfalls before they become emergencies.

- You become more motivated to pay down debt because you can see, in writing, the impact of each payment.

And when you find extra money, resist the urge to spend it mindlessly. Direct those funds toward building savings or paying down debt more quickly.

Frequently Asked Questions (FAQ) about Daily Cash Flow

Daily tracking can raise practical questions, especially in the first week. These FAQs are designed to help you use the daily cash flow template correctly without getting stuck in the details.

Do I track card spending as “cash out”?

Yes. Even if you didn’t use physical cash, card spending reduces the money available in your account - so it belongs in Cash Out.

What about credit card payments?

Track the payment on the day it leaves your checking account (Cash Out). If you also tracked the original purchases daily, that’s okay. The purpose here is cash availability. (To avoid confusion, some people track daily spending but treat credit card payment as a “transfer” category.)

Should I include bills that haven’t been paid yet?

In daily cash flow tracking, only record what actually happened today. If you want extra control, add a note for upcoming bills due tomorrow/this week.

What if I’m paid weekly or irregularly?

That’s exactly what a daily cash flow tracker is great for. Enter income on the day it arrives and use the template to ensure your due dates won’t outrun your balance.

How detailed should my categories be?

Start broad: Food, Transportation, Bills, Debt, Misc. After a week, you’ll naturally see where detail helps (like separating “Groceries” from “Eating out”).

What if I miss a day?

Don’t quit. Fill in yesterday from your bank/receipts, then continue today. Consistency beats perfection.

Is this a budget?

Not exactly. This is a daily cash flow template: it tracks reality day-by-day. Pair it with a simple budget if you want planned limits by category.

How Daily Cash Flow Fits into “10 Steps to Conquer Debt”

Our daily cash flow template is one tool in a complete system for taking control of your financial life.

Understanding cash flow management is just one step in our “10 Steps to Conquer Debt” system.

By combining:

- A clear picture of your income and expenses,

- A daily cash flow plan, and

- Consistent, intentional action - you can move steadily toward a debt‑free life.

Download 10 Steps to Conquer Debt eBook

Download the free ebook today: 10 Steps to Conquer Debt (PDF) Inside, you’ll discover additional practical tools and strategies that work hand‑in‑hand with this daily cash flow worksheet. Also, you can immediately access our free Daily Cash Flow Template: PDF | Excel File

To access all of our free leadership tools simply subscribe to our free newsletter. You will immediately receive a password that grants access to our entire leadership tools library.

Your privacy is important to us. We never share or sell email addresses