- Home

- Leading Self

- Debt Payoff Planner Templates

- Organize Personal Finances

Financial Records Label Template (Free Printable PDF + Excel)

Download our free financial records label template to easily get organized? Organizing your personal finances is not just a “money task” – it’s an act of self‑leadership. When you decide to bring order to your financial life, you’re taking responsibility, creating clarity, and building confidence in every decision you make.

Free Personal Finance Records Label Template: PDF | Excel File

This page gives you a practical tool to do exactly that: a free Financial Records Label Template you can download and use immediately. It’s one part of our larger 10 Steps to Conquer Debt system, designed to help you lead yourself out of financial stress and into greater freedom.

Having a good system in place shortens the road to any important goal. The peace of mind that comes with knowing where all your important records are located goes a long way toward lessening financial anxieties.

What most people fail to realize is just how much time is wasted when they do not have an orderly financial information system in place.

"Organization isn't about perfection. It's about efficiency, reducing stress and clutter, saving time and money, and improving your overall quality of life."

- Christina Scalice

Instead, these folks are always searching for that lost receipt; never getting around to balancing their checkbook; or too often grumbling about why they don't have time to do what they know deep down they need to be doing to keep their financial lives in order.

Use our financial labels template to quickly free yourself from the stress of clutter and disorganization. Gather together all your financial records, bank statements, loan documents, bills, subscriptions, receipts, etc. Separate all your financial records into piles per key categories.

Next, create customized labels that reflect the titles/categories you desire using our free Excel template.

Jump To: Download Free Template | Label Print Settings | Why Organize | Benefits of Organizing | Recommended Labels | How to Organize | Create a Habit | FAQ

Free Template to Organize Financial Records

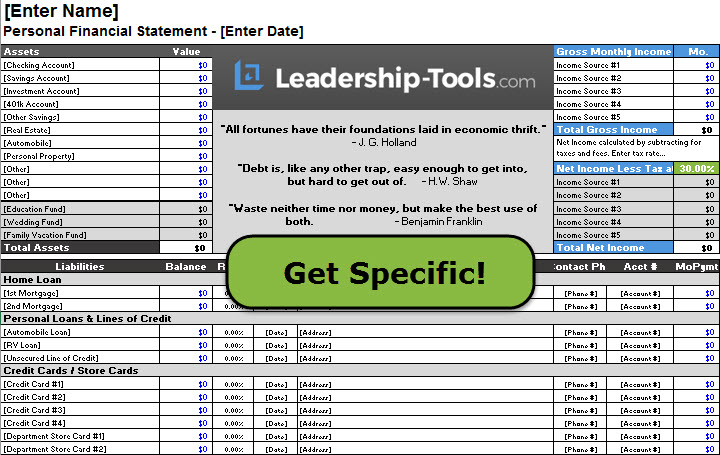

Use our free Financial Records Label Template to quickly bring order to all of your key documents and organize personal finances with confidence.

This ready-to-use template gives you a complete set of file labels for your most important records – bank statements, loan documents, bills, receipts, insurance, taxes, and more. Instead of wondering how to set up your filing system, you can simply print, apply, and start organizing.

When you put this simple system in place, you will:

- Save time by knowing exactly where every document belongs

- Reduce stress because you can quickly find what you need when you need it

- Gain control over your financial life as you see the full picture more clearly

This free tool is part of our Leadership Tools library, which is available exclusively to subscribers of our free Leadership Tools Newsletter.

For your convenience you can download the free Financial Records Label template right here: PDF | Excel File

Print Settings (Use These to Avoid Misaligned Labels)

Before printing your financial records labels, use these settings to keep text aligned and readable:

Print setup checklist

- Print scale: Choose “Actual Size” or 100% (avoid “Fit to Page”)

- Test first: Print one test page on plain paper, then hold it behind the label sheet to confirm alignment

- Paper type: Use full-sheet label paper or standard address label sheets (whichever matches your template)

- Printer feed: If your printer has a manual feed tray, use it to reduce skew

- Ink: “Normal” quality is usually best; “Draft” can look faint on label stock

Label specs (so you can match your supplies)

- Template type: Financial records label template (printable PDF + editable spreadsheet)

- Best use: File folders, binders, envelopes, and document storage boxes

- Tip for folder tabs: Keep label text short (2–4 words) so it’s readable at a glance

Recommended Supplies

Search online for following supplies for best current prices: (These are all available on Amazon)

- File Folder Tabs, Selizo 100 Sets Hanging File Folder Labels 2" Tabs and Inserts for Hanging Files

- Amazon Basics Hanging Organizer File Folders for Efficient Filing, Sturdy, Adjustable Tabs, Letter Size, Pack of 25, Green

- Print using our Template or Create Your Own Labels using Avery Printable Tab Inserts for Hanging File Folders, 1/2" x 2", 1/5 Cut, White, 100 Index Tab Inserts (11136)

Troubleshooting (fast fixes)

- If the text prints too high/low: Confirm 100% scale and re-check your printer’s “borderless” setting (turn borderless OFF)

- If columns drift: Use manual feed and avoid printing double-sided

- If labels peel or smudge: Let ink dry fully; consider “labels for inkjet/laser” that match your printer type

"Organizing is what you do before you do something, so that when you do it, it is not all mixed up."

- A. A. Milne

Why Organizing Your Finances Is Self-Leadership

When most people think about organizing their finances, they think about bills, statements, and numbers. Leaders think differently.

Self‑Leadership Means

- Choosing clarity over confusion

- Designing simple systems that support your goals

- Following through on small habits that build long‑term freedom

Benefits of Organizing Your Financial Records

- Making it easier to understand your true financial picture

- Reducing stress and decision fatigue

- Creating the foundation for bigger leadership decisions about debt, savings, and your future

The Financial Records Label Template you’ll download below is a simple, concrete way to practice self‑leadership with your money.

Key Reasons for Using Our Financial Records Label Template

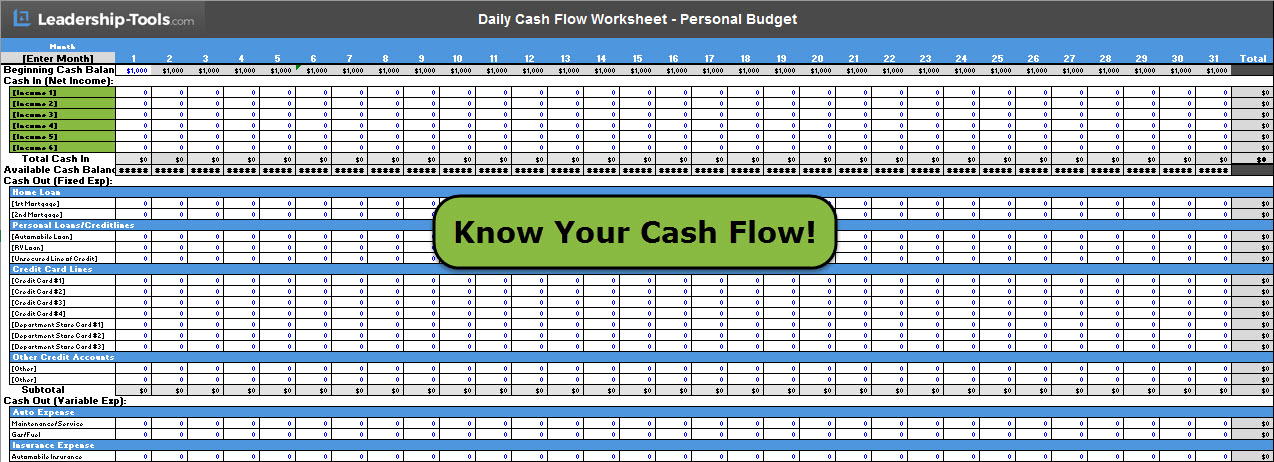

There are major benefits when you take the time to organize your personal finances. As your financial life becomes more orderly, you’ll quickly notice positive changes in how you think, feel, and behave around money.

Here are just a few of the key benefits to keep in mind:

- Lower stress and better mental health. You’ll feel more balanced and poised, with greater optimism because you’re no longer constantly worried about what you might have missed.

- Improved focus and productivity. With your money “house” in order, you free up mental energy to concentrate on your most important personal and professional goals.

- Faster access to important information. Instead of wasting time hunting for lost bills, statements, or receipts, you’ll know exactly where to find what you need, when you need it.

- Reduced expenses and higher net income. When you can clearly see your complete financial picture, you make better decisions, avoid unnecessary fees, and spot easy ways to cut costs and increase cash flow.

- Greater credibility with others. A well-organized financial system builds confidence and trust with the people who see your financial situation up close—your spouse or partner, banker, credit counselor, or other creditors.

- More confidence and self-respect. As you begin handling your money responsibly and proactively, your self-esteem grows and you feel more in control of your future.

Without a doubt, the benefits you gain when you organize your personal finances cannot be overstated. Managing your finances in an organized way is not a temporary fix or something you do only until today’s problems are solved.

Recommended Financial Records Labels (Starter Set)

If you want a simple, reliable system, start with this label set. These categories cover the most common personal finance and household financial records without getting overly complex.

Core label set (copy/paste into the Excel label template)

Banking

- Checking

- Savings

- Credit Cards

- Bank Statements

Income

- Pay Stubs

- W-2 / 1099

- Other Income

Taxes

- Tax Returns (Year)

- Tax Documents (Year)

- Tax Receipts (Year)

Bills & Utilities

- Utilities

- Phone / Internet

- Subscriptions

Insurance

- Health Insurance

- Auto Insurance

- Home / Renters Insurance

- Life Insurance

Home & Property

- Mortgage / Lease

- Property Taxes

- Home Repairs

- Major Purchases / Receipts

- Warranties / Manuals

Vehicles

- Registration

- Maintenance / Repairs

Medical

- Medical Bills

- Explanation of Benefits (EOB)

Investing & Retirement

- 401(k) / 403(b)

- IRA

- Brokerage

- Investment Statements

Personal & Legal

- IDs / Vital Records

- Estate Documents

- Contracts / Agreements

How to customize (keep this simple)

- Add years where needed: “Tax Returns 2026,” “Insurance 2026,” “Medical 2026”

- If you’re self-employed, add: “Quarterly Taxes,” “Business Receipts,” “Invoices,” “Business Banking”

- If you prefer fewer folders, merge categories (example: combine all insurance into one “Insurance” folder)

How to Organize Personal Finances Using Free Labels Template

A financial records label template is only as helpful as the system behind it. The steps below turn your labels into a working filing system, so bills, tax documents, and statements stop piling up in random places.

1. Download and Print Financial Records Labels

Download our free Financial Records Label Template PDF | Excel File

Click to open the file, then print it on regular paper or adhesive label sheets.

Inside the Records Labels template, you’ll find ready-made labels for common categories such as:

- Banking and Savings

- Credit Cards and Loans

- Household Bills and Utilities

- Insurance

- Taxes

- Retirement and Investments

There are also a few blank labels you can customize for your unique situation (for example, “Childcare,” “Side Business,” or “Medical”).

2. Gather Key Financial Documents

Before you start filing, bring everything to one place. Don’t worry about sorting yet — just collect. Look for:

- Bank and credit union statements

- Credit card statements

- Mortgage or rent documents

- Auto, student, and personal loan statements

- Insurance policies (home, auto, life, health, disability)

- Tax returns and supporting records

- Pay stubs and income records

- Retirement and investment statements

- Any other recurring bills or important financial paperwork

Place everything on a clear surface (table, desk, or even the floor). This is your “starting point” as a money leader - you’re facing reality with courage instead of avoiding it.

3. Create Labeled Folders or Envelopes

Next, turn your printed labels into a simple, easy-to-maintain filing system.

- Choose your containers: Use file folders, large envelopes, or an accordion file - whatever you already have on hand.

- Attach the labels: Cut out or peel each label and attach it to a folder or section. Start with the core categories from the template.

- Add custom labels if needed: Use the blank labels to create categories that fit your life (e.g., “Small Business,” “College Savings,” “Medical Bills”).

Aim for a healthy balance: Create enough folders to keep things clear, but not so many that the system becomes complicated. Your goal as a self-leader is to keep things simple for easy ongoing maintenance.

4. File Documents with a Self-Leadership Mindset

Now, take each document from your pile and make a decision: “Where does this belong?”

- Decide intentionally: For every paper, pause for just a moment and choose the best folder. This is you taking ownership of your financial life, one small decision at a time.

- Think of your future self: Ask, “If I needed this quickly six months from now, where would I naturally look for it?” File it there.

- Finish the job: Work through the entire stack until every document has a home. Don’t leave half-filled piles lying around. Leaders finish a job completely.

As you go, you may notice gaps (missing statements, expired policies, unclear balances). Simply jot these down on a notepad - you’ll address them during your upcoming “Money Leadership” session.

5. Schedule Your First “Money Leadership” Session

To turn this from a one-time clean-up into a true leadership habit, schedule dedicated time on your calendar.

Set aside 30–60 minutes within the next week for your first “Money Leadership” session. During that time, you will:

- Finish any remaining filing and tidy up your space

- Review each labeled folder and confirm you have what you need

- Note any missing documents or questions you want to resolve

- Identify any debts, fees, or issues you’d like to tackle using the 10 Steps to Conquer Debt system

Give this session a name in your calendar (for example, “Money Leadership – Step 2: Organize”) so it feels important — because it is.

By the end of this process, you’ll have a clear, organize personal finance records using a simple routine you can build on. This one tool becomes a practical expression of self-leadership and a strong foundation for moving confidently through the rest of the 10 Steps to Conquer Debt.

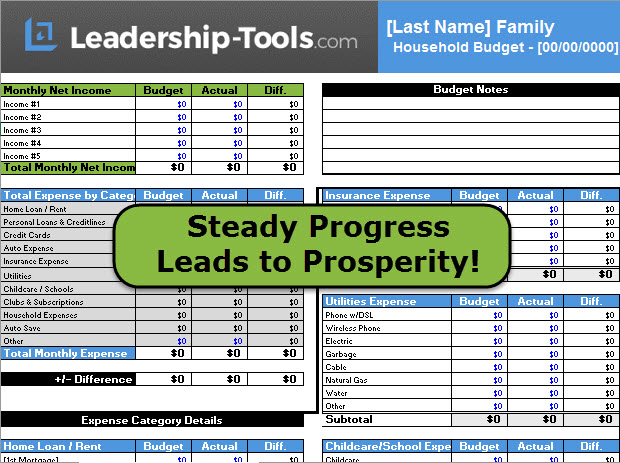

Make It a Habit: Your Personal Finance Self-Leadership Routine

Creating a system to organize personal finance records is powerful. Using it consistently is where true self‑leadership shows up. The Financial Records Label Template is designed to make that easy - all you need is a simple routine you can repeat month after month.

Here’s a straightforward habit you can follow:

1. Choose Your Regular “Money Leadership” Time (as defined earlier)

Pick a specific day and time that fits your life. For example:

- The first Saturday of every month, or

- Every other Sunday evening, or

- The 15th of each month, after work

Put it on your calendar as a recurring appointment and treat it like any other important meeting. Remember, good leaders show up for their commitments.

2. Spend 15–30 Minutes Updating Your Folders

During each session, use your labeled system to quickly bring everything up to date:

- File new statements, bills, and important notices into the correct folders

- Remove obvious clutter you no longer need (expired offers, duplicates, junk)

- Add any new categories or custom labels if your situation has changed

Because your labels are already in place, this should be fast and almost automatic. The goal is to stay current, not to be perfect.

3. Scan for Gaps and Issues

Next, take a quick look through your folders:

- Is anything missing that you expected to see?

- Are there bills you haven’t opened yet?

- Do any accounts, fees, or interest rates concern you?

Jot down a short list of follow‑ups. You don’t need to solve everything during this short session - you just need to notice and capture what needs attention.

4. Acknowledge Your Progress

Self‑leadership includes recognizing growth. At the end of each session, pause for a moment and notice:

- Your paperwork is no longer in random piles

- You can find key documents in seconds

- You feel more informed and in control

You may still have financial challenges, but you’re no longer avoiding them. You’re leading yourself through them.

5. Connect the Habit to the 10 Steps to Conquer Debt

As this routine becomes familiar, you’ll be ready to go beyond organizing and into active change. Your labeled system makes it easier to:

- Organize financial records - seeing all your debts clearly

- Gather the numbers you need for a payoff plan

- Track progress as balances decrease

That’s where the 10 Steps to Conquer Debt system comes in. This monthly “Money Leadership Session” habit gives you the organized information and confidence you need to apply each step - from clarifying your debts to creating a realistic, leadership-driven plan for becoming debt‑free.

Used consistently, this simple routine does more than organize personal finance records. It reinforces your identity as the leader of your financial life, turning a basic filing system into an ongoing act of self‑leadership.

Frequently Asked Questions (FAQ)

Questions come up fast when you’re trying to print and apply labels. These are the most common ones from people organizing personal finance paperwork.

Is this financial records label template really free?

Yes. Download the PDF for fast printing or the Excel file if you want to customize your label names.

Can I use regular paper instead of label sheets?

Yes. Print on plain paper, then tape labels to folders or place them in clear label tabs.

Why are my labels printing misaligned?

Common fixes:

- Set print scale to 100% / “Actual size”

- Print a test page on plain paper first

- Confirm alignment before printing on label sheets

What if I don’t see a category I need?

Use the Excel version to add custom labels. A simple approach is to add a label only after you’ve searched for the same “missing category” twice.

Is this only for personal finances?

No. It works for personal finances and for simple small-business or side-income paperwork when you add a few business categories.

10 Steps to Conquer Debt eBook

Getting your financial affairs in order is just one step in our 10 Steps to Conquer Debt system. Download the free eBook today!

Organize personal finance records now with our free Personal Financial Records Label Template: PDF | Excel File

To access all of our free leadership tools simply subscribe to our free newsletter. You will immediately receive a password that grants access to our entire leadership tools library.

Your privacy is important to us. We never share or sell email addresses.