- Home

- Leading Self

- Goal Setting for Success Course

- Exhibit B, Financial Goal Plan

Free Financial Goal Plan Template Using a Master Action Plan (M.A.P.)

Exhibit B: Set Financial Goals Using M.A.P.

This free financial goal plan template will help you turn vague money wishes into a clear, written plan you can follow every week. By walking through a real financial goal plan example using our Master Action Plan (M.A.P.) tool, you’ll see exactly how to set clear money goals and take consistent action.

A solid financial goal plan is one of the most powerful tools you can give yourself as a leader. Money affects your options, your stress level, your family and your ability to say “yes” to the opportunities that matter most. Yet many new and aspiring leaders, frontline managers and solopreneurs still rely on vague wishes like “get out of debt” or “save more” instead of a written financial goal plan they can actually follow.

Download Free: Goal Setting for Success eBook

That’s where a clear financial goal plan template comes in. When you can see your numbers, your deadline and your specific action steps all in one place, everything changes. You stop guessing. You start acting. You know exactly what to do this week to move closer to the financial future you want.

In this chapter of the Goal Setting for Success personal goal setting course, you’ll walk through a complete financial goal plan example using our Master Action Plan (M.A.P.) tool. You’ll see how to take one money goal, plug it into the M.A.P., and turn it into a simple, realistic financial goal planning worksheet that you can reuse for any money goal in your life or business.

Jump To: What Is a Financial Goal Plan? | Common Types of Financial Goals | How to Use the M.A.P. Financial Goal Plan Template | Free M.A.P. Template |Financial Goal Plan Example | Mini Worksheet: Customize Your Own Financial Goal Plan | Financial Goal Plan Checklist |FAQs | Next Steps | Download eBook

What Is a Financial Goal Plan?

A financial goal plan is a written roadmap for your money. It defines the specific financial results you want, when you want them, and the actions you’ll take to get there. Instead of vague intentions like “save more” or “pay off debt someday,” a true financial goal plan answers:

- What exactly do I want to achieve with my money?

- Why does this financial goal matter to me and the people I lead?

- When will I achieve it?

- What will I do each month and each week to reach it?

- What might get in the way, and how will I respond?

On this page, you’ll turn your answers into a simple, practical financial goal plan template using the Master Action Plan (M.A.P.). Once you learn the process, you can use this same financial goal planning worksheet for any area of your finances, including savings, debt, investing, or business cash flow.

Common Types of Financial Goals

Before you complete your own financial goal plan, it helps to see where your goal fits. Financial goals usually fall into three timeframes.

Short-Term Financial Goals (0–2 Years)

Short-term goals are “near future” money targets. Examples include:

- Building a $1,000–$5,000 emergency fund

- Paying off one high‑interest credit card

- Saving for a weekend trip or special purchase

- Catching up on a couple of missed bill payments

These are great goals for building momentum. A short-term financial goal plan template helps you see quick wins and prove to yourself that you can follow through.

Medium-Term Financial Goals (2–5 Years)

Medium-term goals usually require more planning and discipline:

- Saving for a reliable car

- Paying down a student loan balance

- Saving for a home down payment

- Building a larger emergency reserve (3–6 months of expenses)

Your Master Action Plan will help you break these bigger goals into monthly and weekly financial actions you can manage.

Long-Term Financial Goals (5+ Years)

Long-term financial goals shape your future:

- Saving for retirement

- Paying off your mortgage

- Building investment income

- Funding college or education for children or grandchildren

These goals often feel overwhelming if you stare at the big number. A clear financial goal planning tool lets you work backward and focus on the next step, not just the distant finish line.

In the financial goal plan example below, we’ll focus on a short‑ to medium‑term goal so you can clearly see how to use the M.A.P. financial goal plan template. Once you understand the process, you can apply it to any timeframe.

How to Use the M.A.P. Financial Goal Plan Template

What Is a Master Action Plan (M.A.P.) Financial Goal Plan?

A Master Action Plan (M.A.P.) is a straightforward financial goal plan template that turns your money goals into specific, scheduled action steps. It takes you from:

- “I want to be better with money” to “I will save $100 per week, starting Monday, by doing these three specific things.”

Instead of a long, complicated budget, your M.A.P. is a one‑page financial goal planning worksheet that keeps the focus on action.

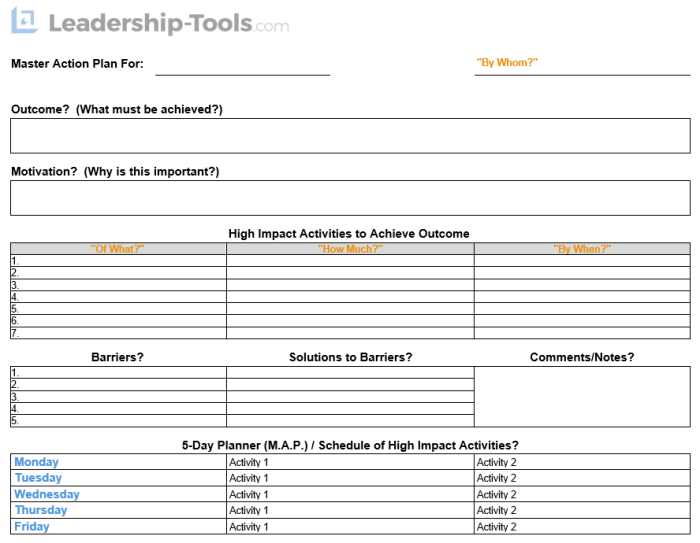

Download Your Free M.A.P. Financial Goal Planning Worksheet

Before you go any further, download and print your free Master Action Plan (M.A.P.) financial goal plan template so you can work along with the example.

Free Financial Goal Plan (M.A.P.) Template Download: PDF | Word File

(Use the PDF if you want to print and write by hand. Use the Word file if you prefer to type directly into the template.)

Financial Goal Plan Example: Step‑By‑Step M.A.P. Walkthrough

For quick reference, here’s how we’ll build this financial goal plan example:

- Define one clear financial goal and deadline

- Clarify your “why” so you stay motivated

- Break the goal into realistic monthly and weekly money actions

- Identify likely obstacles and your planned responses

- Use a 5‑day starter plan to build early momentum

Now let’s walk through each part of the M.A.P. financial goal plan template.

Step 1 – Define One Clear Financial Goal and Deadline

On your M.A.P. worksheet, write a single, specific goal. Here’s a SMART‑style financial goal example:

- - “Save $5,000 in the next 12 months to build an emergency fund.”

Why This Works as a SMART Financial Goal

- Specific: Save $5,000 for an emergency fund.

- Measurable: You can track the dollar amount each month.

- Achievable: You’ll test this shortly by breaking it down.

- Relevant: It builds security for you, your family and your leadership.

- Time‑bound: 12‑month deadline.

On your own financial goal plan template, write your version in one sentence. Don’t worry if it feels big. The next steps will make it manageable.

Step 2 – Clarify Your “Why” So You Stay Motivated

Under your written goal, list 3–5 reasons this financial goal matters. For example:

- I want to protect my family from surprise expenses.

- I don’t want money stress to distract me from leading well.

- I want the freedom to say “yes” to opportunities without panic.

This “why” section is critical. When you hit a rough week, your emotional reasons will keep you connected to your financial goal plan long after the excitement wears off.

On your M.A.P. worksheet, label this section “Why This Financial Goal Matters” and fill it in fully.

Step 3 – Break the Goal into Monthly and Weekly Money Actions

Now we translate your big number into bite‑sized actions.

Using our financial goal plan example, saving $5,000 in 12 months:

- $5,000 ÷ 12 months ≈ $417 per month

- $417 ÷ 4 weeks ≈ $105 per week

Round as needed to make your plan simple to follow. For example, decide to save $100 per week and know you’ll add a bit extra some months.

On your financial goal planning worksheet, create two short lists:

Monthly Financial Actions

Examples:

- Review previous month’s spending and identify two expenses to reduce

- Transfer total monthly savings to your emergency account

- Update your M.A.P. with your new emergency fund balance

Weekly Financial Actions

Examples:

- Automatically transfer $100 to savings every Friday

- Make one small cut (e.g., one meal out, one subscription, a small impulse purchase)

- Record your new savings balance in your M.A.P.

These simple lists turn your financial goal plan template into a weekly to‑do list you can actually follow.

Step 4 – Anticipate Obstacles and Plan Your Responses

Every meaningful financial goal plan will face obstacles. The difference between success and frustration is how you prepare for them.

On your M.A.P. worksheet, add a section labeled “Obstacles & Responses.” Then list:

Obstacle: Unexpected expense (car repair, medical bill)

Response: Pause extra debt payments that month, maintain minimums, resume as soon as possible.

Obstacle: Overspending due to stress or emotions

Response: Wait 24 hours before any unplanned purchase over $50; talk with a partner or accountability friend before deciding.

Obstacle: Irregular income (for solopreneurs or commission‑based leaders)

Response: Set a minimum weekly savings amount and add bonus contributions from higher‑income weeks.

This step keeps your financial goal plan realistic. You’re not hoping obstacles won’t happen, you’re planning how to handle them when they do.

Step 5 – Create a 5‑Day Starter Financial Goal Plan

Big financial goals can feel heavy. A short “starter sprint” helps you build momentum fast.

On a clean section of your financial goal plan template, create a simple 5‑day plan:

- Day 1: Open or confirm your dedicated savings account and transfer your first amount (even if it’s small).

- Day 2: Review last month’s spending and highlight everything you could have skipped.

- Day 3: Choose two expenses to reduce or remove for the next 30 days.

- Day 4: Set up automatic weekly or monthly transfers to your savings or debt goal.

- Day 5: Review your M.A.P., celebrate starting, and schedule your first weekly review.

You’ve now moved from “someday I’ll get my finances together” to a living, breathing financial goal plan you’re already acting on.

"Financial peace isn't the acquisition of stuff. It's learning to live on less than you make, so you can give money back and have money to invest. You can't win until you do this."

- Dave Ramsey

Mini Worksheet – Customize Your Own Financial Goal Plan

Now it’s your turn. Grab your printed M.A.P. financial goal planning worksheet and fill it in using these prompts.

Short Reflection Exercise

Answer these questions in writing:

- What is the single most important financial goal I want to focus on for the next 6–12 months?

- Why does this goal matter to me as a leader, partner, parent or business owner?

- What will change in my life when I achieve this goal?

- What fears or doubts show up when I think about this goal?

- What is one small action I can take this week to prove to myself that I’m serious?

Use your answers to complete:

- Your main goal statement

- Your “why” section

- Your first weekly and monthly actions

Turn Your Answers into a Simple Financial Goal Plan Template

On your M.A.P. worksheet, complete:

Main Goal & Deadline

- Write one sentence that describes your financial goal and your target date.

Why This Goal Matters

- List 3–5 reasons that connect your financial goal to your values, your family and your leadership.

Monthly & Weekly Actions

- Break your big number (or outcome) down into monthly and weekly targets.

- Write specific actions: transfers, spending cuts, income boosts, review times.

Obstacles & Responses

- List at least three obstacles you’re likely to face.

- For each, write one practical response in advance.

Once you’ve filled in your financial goal plan template, you now have a clear, written financial goal planning tool you can review and refine every week.

Financial Goal Plan Checklist

Use this quick checklist to make sure your financial goal plan is complete:

"No one's ever achieved financial fitness with a January resolution that's abandoned by February. - Suze Orman"

- I wrote one clear financial goal and a specific deadline.

- I captured my top 3–5 reasons why this goal matters.

- I broke my main goal into realistic monthly and weekly money actions.

- I identified at least three likely obstacles and wrote responses for each.

- I scheduled a weekly or monthly review time in my calendar.

- I took at least one action (even a small one) to start my plan this week.

If you can check each box, you’re no longer just hoping for better finances, you’re working a real financial goal plan.

Financial Goal Plan FAQs

How do I create a financial goal plan?

Start by choosing one clear money goal and a realistic deadline. Then use a simple financial goal plan template like the Master Action Plan (M.A.P.) to write your goal, your reasons, your monthly and weekly actions, and your likely obstacles.

Finally, schedule a regular review so your plan stays alive and useful.

What is an example of a financial goal?

One example is: “Save $5,000 in the next 12 months to build an emergency fund.” Another is: “Pay off $3,000 of credit card debt in 10 months by paying $300 per month and cutting two discretionary expenses.”

The financial goal plan example on this page shows you how to turn these goals into a step‑by‑step action plan.

How often should I review my financial goal plan?

At minimum, review your financial goal plan once a month to compare your actual numbers with your plan.

Many leaders find a short weekly review, even 10–15 minutes, is ideal. That’s enough time to update your M.A.P., adjust your next actions and stay emotionally connected to your financial goals.

Can I use one template for multiple financial goals?

Yes, but it’s usually best to focus your M.A.P. financial goal planning worksheet on one primary goal at a time.

Once you’ve built momentum and progress with that goal, you can either add a second goal or create a new financial goal plan template for the next priority.

Next Steps – Integrate This Financial Goal Plan Into Your Life

Your financial goal plan template is only as powerful as the actions you take with it. Here’s how to integrate this tool into your everyday leadership and life:

- Keep your M.A.P. where you’ll see it, such as near your desk, on your fridge, or in your planner.

- Review your financial goal plan at the same time each week and month.

- Celebrate small wins: every transfer, every payment, every reduced expense.

- When life changes, adjust your plan instead of abandoning it.

This financial goal plan example is one section in the larger Goal Setting for Success personal goal setting course. As you complete plans for your finances, fitness, career and relationships, you’re building a complete picture of the life you want, and a concrete path to get there.

Use this financial goal planning tool as often as you need. Over time, you’ll discover that a well‑crafted financial goal plan doesn’t just change your numbers. It changes your confidence, your options and your ability to lead yourself and others with calm, focused strength.

Download Goal Setting for Success eBook

Download our free Goal Setting for Success eBook: Download PDF

Inside, you’ll get: The full step‑by‑step course content for all chapters and sections; Motivational Lessons for Success at the end of each chapter; Worksheets and examples you can print or use digitally; and Guidance tailored to both personal life and leadership at work.

To access all of our tools simply subscribe to our free newsletter. You will immediately receive a password that grants access to our entire leadership tools library.

Your privacy is important to us. We never share or sell email addresses.